ANNUAL REPORT 2010

ANNUAL REPORT 2010

ANNUAL REPORT 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

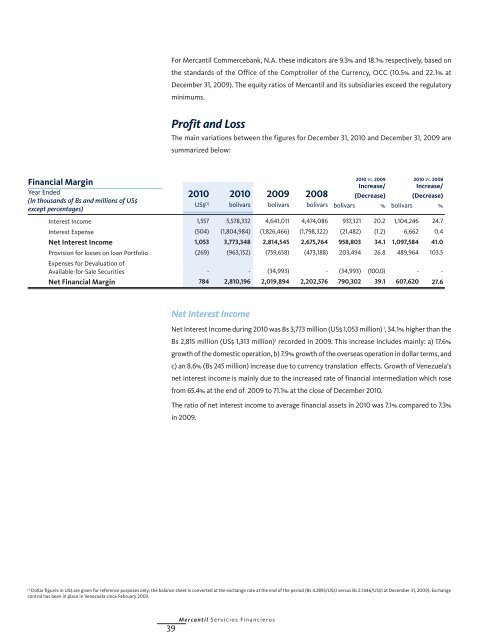

Financial Margin<br />

Year Ended<br />

(In thousands of Bs and millions of US$<br />

except percentages)<br />

Interest Income<br />

Interest Expense<br />

Net Interest Income<br />

Provision for losses on loan Portfolio<br />

Expenses for Devaluation of<br />

Available-for-Sale Securities<br />

Net Financial Margin<br />

For Mercantil Commercebank, N.A. these indicators are 9.3% and 18.1% respectively, based on<br />

the standards of the Office of the Comptroller of the Currency, OCC (10.5% and 22.1% at<br />

December 31, 2009). The equity ratios of Mercantil and its subsidiaries exceed the regulatory<br />

minimums.<br />

Profit and Loss<br />

The main variations between the figures for December 31, <strong>2010</strong> and December 31, 2009 are<br />

summarized below:<br />

<strong>2010</strong><br />

US$ (1)<br />

1,557<br />

(504)<br />

1,053<br />

(269)<br />

-<br />

784<br />

<strong>2010</strong><br />

bolivars<br />

5,578,332<br />

(1,804,984)<br />

3,773,348<br />

(963,152)<br />

-<br />

2,810,196<br />

Net Interest Income<br />

4,641,011<br />

(1,826,466)<br />

2,814,545<br />

(759,658)<br />

(34,993)<br />

2,019,894<br />

Net Interest Income during <strong>2010</strong> was Bs 3,773 million (US$ 1,053 million) 1 , 34.1% higher than the<br />

Bs 2,815 million (US$ 1,313 million) 1 recorded in 2009. This increase includes mainly: a) 17.6%<br />

growth of the domestic operation, b) 7.9% growth of the overseas operation in dollar terms, and<br />

c) an 8.6% (Bs 245 million) increase due to currency translation effects. Growth of Venezuela’s<br />

net interest income is mainly due to the increased rate of financial intermediation which rose<br />

from 65.4% at the end of 2009 to 71.1% at the close of December <strong>2010</strong>.<br />

The ratio of net interest income to average financial assets in <strong>2010</strong> was 7.1% compared to 7.3%<br />

in 2009.<br />

(1) Dollar figures in US$ are given for reference purposes only; the balance sheet is converted at the exchange rate at the end of the period (Bs 4.2893/US$1 versus Bs 2.1446/US$1 at December 31, 2009). Exchange<br />

control has been in place in Venezuela since February 2003.<br />

Mercantil Servicios Financieros<br />

39<br />

2009<br />

bolivars<br />

2008<br />

bolivars<br />

4,474,086<br />

(1,798,322)<br />

2,675,764<br />

(473,188)<br />

-<br />

2,202,576<br />

<strong>2010</strong> Vs. 2009<br />

Increase/<br />

(Decrease)<br />

bolivars %<br />

937,321<br />

(21,482)<br />

958,803<br />

203,494<br />

(34,993)<br />

790,302<br />

20.2<br />

(1.2)<br />

34.1<br />

26.8<br />

(100.0)<br />

39.1<br />

<strong>2010</strong> Vs. 2008<br />

Increase/<br />

(Decrease)<br />

bolivars %<br />

1,104,246<br />

6,662<br />

1,097,584<br />

489,964<br />

-<br />

607,620<br />

24.7<br />

0.4<br />

41.0<br />

103.5<br />

-<br />

27.6