Operational tools and adaptive management

Operational tools and adaptive management

Operational tools and adaptive management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

w0 implies compensation to the fishers. The characteristics of the two parameters in the<br />

incentive scheme, i.e. how they vary with the interest weights <strong>and</strong> other exogenous variables<br />

<strong>and</strong> parameters, are given in table 3.3.<br />

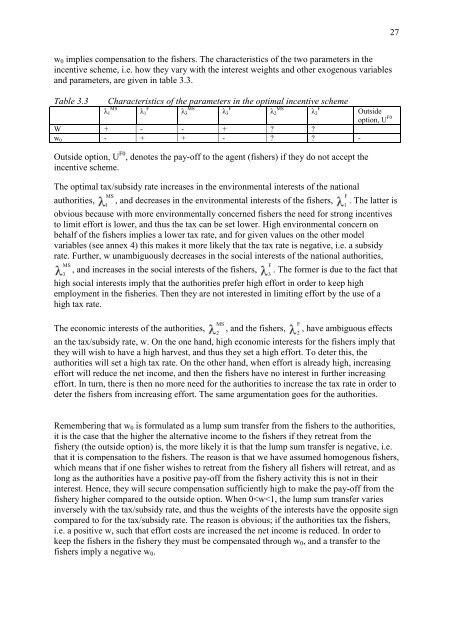

Table 3.3 Characteristics of the parameters in the optimal incentive scheme<br />

λ1 MS λ1 F λ3 MS λ3 F λ2 MS λ2 F Outside<br />

option, U F0<br />

W + - - + ? ?<br />

w0 - + + - ? ? -<br />

Outside option, U F0 , denotes the pay-off to the agent (fishers) if they do not accept the<br />

incentive scheme.<br />

The optimal tax/subsidy rate increases in the environmental interests of the national<br />

, <strong>and</strong> decreases in the environmental interests of the fishers, . The latter is<br />

1 1<br />

obvious because with more environmentally concerned fishers the need for strong incentives<br />

to limit effort is lower, <strong>and</strong> thus the tax can be set lower. High environmental concern on<br />

behalf of the fishers implies a lower tax rate, <strong>and</strong> for given values on the other model<br />

variables (see annex 4) this makes it more likely that the tax rate is negative, i.e. a subsidy<br />

rate. Further, w unambiguously decreases in the social interests of the national authorities,<br />

authorities, MS<br />

MS<br />

, <strong>and</strong> increases in the social interests of the fishers, . The former is due to the fact that<br />

3 3<br />

high social interests imply that the authorities prefer high effort in order to keep high<br />

employment in the fisheries. Then they are not interested in limiting effort by the use of a<br />

high tax rate.<br />

The economic interests of the authorities, MS<br />

, <strong>and</strong> the fishers, , have ambiguous effects<br />

2 2<br />

an the tax/subsidy rate, w. On the one h<strong>and</strong>, high economic interests for the fishers imply that<br />

they will wish to have a high harvest, <strong>and</strong> thus they set a high effort. To deter this, the<br />

authorities will set a high tax rate. On the other h<strong>and</strong>, when effort is already high, increasing<br />

effort will reduce the net income, <strong>and</strong> then the fishers have no interest in further increasing<br />

effort. In turn, there is then no more need for the authorities to increase the tax rate in order to<br />

deter the fishers from increasing effort. The same argumentation goes for the authorities.<br />

Remembering that w0 is formulated as a lump sum transfer from the fishers to the authorities,<br />

it is the case that the higher the alternative income to the fishers if they retreat from the<br />

fishery (the outside option) is, the more likely it is that the lump sum transfer is negative, i.e.<br />

that it is compensation to the fishers. The reason is that we have assumed homogenous fishers,<br />

which means that if one fisher wishes to retreat from the fishery all fishers will retreat, <strong>and</strong> as<br />

long as the authorities have a positive pay-off from the fishery activity this is not in their<br />

interest. Hence, they will secure compensation sufficiently high to make the pay-off from the<br />

fishery higher compared to the outside option. When 0