Operational tools and adaptive management

Operational tools and adaptive management

Operational tools and adaptive management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

When we formulate the common incentive scheme as follows; c 0 cE j,<br />

the tax/subsidy rate<br />

c, <strong>and</strong> the lump sum transfer c0, relate to the incentive scheme of the single principal, the<br />

authorities, as shown in table 3.4.<br />

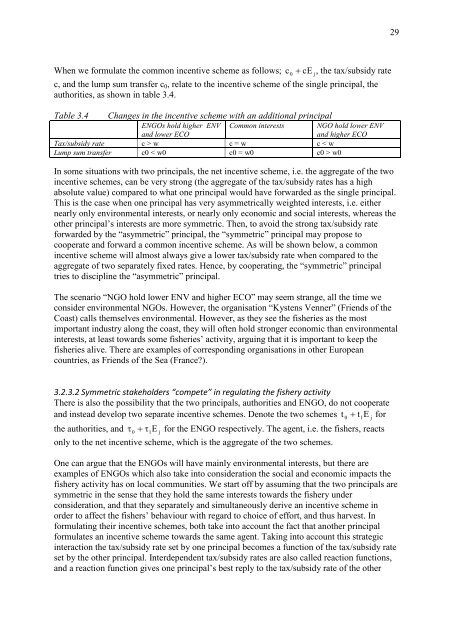

Table 3.4 Changes in the incentive scheme with an additional principal<br />

ENGOs hold higher ENV Common interests NGO hold lower ENV<br />

<strong>and</strong> lower ECO<br />

<strong>and</strong> higher ECO<br />

Tax/subsidy rate c > w c = w c < w<br />

Lump sum transfer c0 < w0 c0 = w0 c0 > w0<br />

In some situations with two principals, the net incentive scheme, i.e. the aggregate of the two<br />

incentive schemes, can be very strong (the aggregate of the tax/subsidy rates has a high<br />

absolute value) compared to what one principal would have forwarded as the single principal.<br />

This is the case when one principal has very asymmetrically weighted interests, i.e. either<br />

nearly only environmental interests, or nearly only economic <strong>and</strong> social interests, whereas the<br />

other principal‟s interests are more symmetric. Then, to avoid the strong tax/subsidy rate<br />

forwarded by the “asymmetric” principal, the “symmetric” principal may propose to<br />

cooperate <strong>and</strong> forward a common incentive scheme. As will be shown below, a common<br />

incentive scheme will almost always give a lower tax/subsidy rate when compared to the<br />

aggregate of two separately fixed rates. Hence, by cooperating, the “symmetric” principal<br />

tries to discipline the “asymmetric” principal.<br />

The scenario “NGO hold lower ENV <strong>and</strong> higher ECO” may seem strange, all the time we<br />

consider environmental NGOs. However, the organisation “Kystens Venner” (Friends of the<br />

Coast) calls themselves environmental. However, as they see the fisheries as the most<br />

important industry along the coast, they will often hold stronger economic than environmental<br />

interests, at least towards some fisheries‟ activity, arguing that it is important to keep the<br />

fisheries alive. There are examples of corresponding organisations in other European<br />

countries, as Friends of the Sea (France?).<br />

3.2.3.2 Symmetric stakeholders “compete” in regulating the fishery activity<br />

There is also the possibility that the two principals, authorities <strong>and</strong> ENGO, do not cooperate<br />

<strong>and</strong> instead develop two separate incentive schemes. Denote the two schemes t 0 t1E<br />

j for<br />

the authorities, <strong>and</strong> 0 1E<br />

j for the ENGO respectively. The agent, i.e. the fishers, reacts<br />

only to the net incentive scheme, which is the aggregate of the two schemes.<br />

One can argue that the ENGOs will have mainly environmental interests, but there are<br />

examples of ENGOs which also take into consideration the social <strong>and</strong> economic impacts the<br />

fishery activity has on local communities. We start off by assuming that the two principals are<br />

symmetric in the sense that they hold the same interests towards the fishery under<br />

consideration, <strong>and</strong> that they separately <strong>and</strong> simultaneously derive an incentive scheme in<br />

order to affect the fishers‟ behaviour with regard to choice of effort, <strong>and</strong> thus harvest. In<br />

formulating their incentive schemes, both take into account the fact that another principal<br />

formulates an incentive scheme towards the same agent. Taking into account this strategic<br />

interaction the tax/subsidy rate set by one principal becomes a function of the tax/subsidy rate<br />

set by the other principal. Interdependent tax/subsidy rates are also called reaction functions,<br />

<strong>and</strong> a reaction function gives one principal‟s best reply to the tax/subsidy rate of the other<br />

29