Operational tools and adaptive management

Operational tools and adaptive management

Operational tools and adaptive management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Then we have a situation with two symmetric principals, both aiming at individually <strong>and</strong><br />

simultaneously regulating a specific fishery. Symmetry means that they both hold<br />

environmental as well as economic <strong>and</strong> social interests towards the fishery under<br />

consideration.<br />

Let the incentive schemes of the two principals (authorities <strong>and</strong> the MSC) be given by<br />

z zE ), ( , E )<br />

( 0 j 0 j respectively.<br />

Then, when both principals take into consideration the existence of a second principal which<br />

also exert influence upon the effort applied in the specific fishery, their optimal tax/subsidy<br />

parameters will have the characteristics as given in table 3.15.<br />

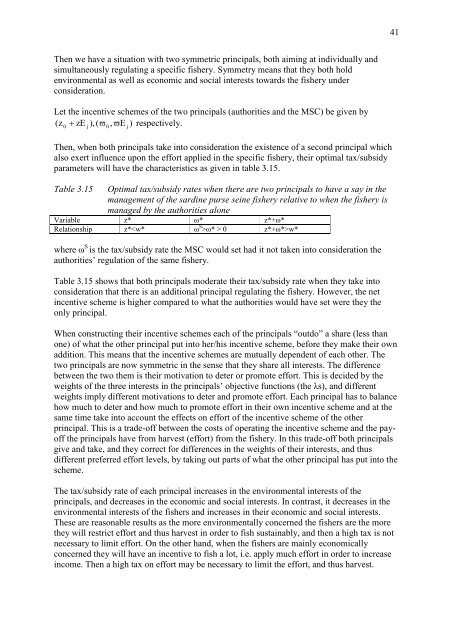

Table 3.15 Optimal tax/subsidy rates when there are two principals to have a say in the<br />

<strong>management</strong> of the sardine purse seine fishery relative to when the fishery is<br />

managed by the authorities alone<br />

Variable z* ω* z*+ω*<br />

Relationship z*ω* > 0 z*+ω*>w*<br />

where ω S is the tax/subsidy rate the MSC would set had it not taken into consideration the<br />

authorities‟ regulation of the same fishery.<br />

Table 3.15 shows that both principals moderate their tax/subsidy rate when they take into<br />

consideration that there is an additional principal regulating the fishery. However, the net<br />

incentive scheme is higher compared to what the authorities would have set were they the<br />

only principal.<br />

When constructing their incentive schemes each of the principals “outdo” a share (less than<br />

one) of what the other principal put into her/his incentive scheme, before they make their own<br />

addition. This means that the incentive schemes are mutually dependent of each other. The<br />

two principals are now symmetric in the sense that they share all interests. The difference<br />

between the two them is their motivation to deter or promote effort. This is decided by the<br />

weights of the three interests in the principals‟ objective functions (the λs), <strong>and</strong> different<br />

weights imply different motivations to deter <strong>and</strong> promote effort. Each principal has to balance<br />

how much to deter <strong>and</strong> how much to promote effort in their own incentive scheme <strong>and</strong> at the<br />

same time take into account the effects on effort of the incentive scheme of the other<br />

principal. This is a trade-off between the costs of operating the incentive scheme <strong>and</strong> the payoff<br />

the principals have from harvest (effort) from the fishery. In this trade-off both principals<br />

give <strong>and</strong> take, <strong>and</strong> they correct for differences in the weights of their interests, <strong>and</strong> thus<br />

different preferred effort levels, by taking out parts of what the other principal has put into the<br />

scheme.<br />

The tax/subsidy rate of each principal increases in the environmental interests of the<br />

principals, <strong>and</strong> decreases in the economic <strong>and</strong> social interests. In contrast, it decreases in the<br />

environmental interests of the fishers <strong>and</strong> increases in their economic <strong>and</strong> social interests.<br />

These are reasonable results as the more environmentally concerned the fishers are the more<br />

they will restrict effort <strong>and</strong> thus harvest in order to fish sustainably, <strong>and</strong> then a high tax is not<br />

necessary to limit effort. On the other h<strong>and</strong>, when the fishers are mainly economically<br />

concerned they will have an incentive to fish a lot, i.e. apply much effort in order to increase<br />

income. Then a high tax on effort may be necessary to limit the effort, <strong>and</strong> thus harvest.<br />

41