2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22 <strong>Aon</strong> Hewitt<br />

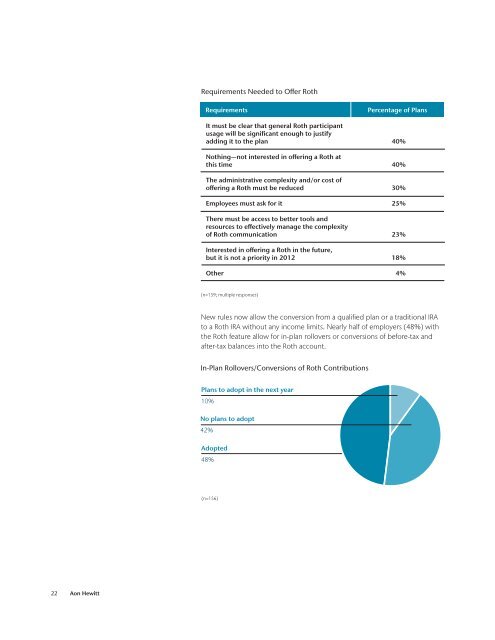

Requirements Needed to O�er Roth<br />

Requirements<br />

It must be clear that general Roth participant<br />

usage will be significant enough to justify<br />

add<strong>in</strong>g it to the plan<br />

Noth<strong>in</strong>g—not <strong>in</strong>terested <strong>in</strong> o�er<strong>in</strong>g a Roth at<br />

this time<br />

The adm<strong>in</strong>istrative complexity and/or cost of<br />

o�er<strong>in</strong>g a Roth must be reduced<br />

Employees must ask for it<br />

There must be access to better tools and<br />

resources to e�ectively manage the complexity<br />

of Roth communication<br />

Interested <strong>in</strong> o�er<strong>in</strong>g a Roth <strong>in</strong> the future,<br />

but it is not a priority <strong>in</strong> <strong>2012</strong><br />

Other<br />

(n=159; multiple responses)<br />

Percentage of Plans<br />

40%<br />

40%<br />

30%<br />

25%<br />

23%<br />

18%<br />

New rules now allow the conversion from a qualified plan or a traditional IRA<br />

to a Roth IRA without any <strong>in</strong>come limits. Nearly half of employers (48%) with<br />

the Roth feature allow for <strong>in</strong>-plan rollovers or conversions of before-tax and<br />

after-tax balances <strong>in</strong>to the Roth account.<br />

In-Plan Rollovers/Conversions of Roth Contributions<br />

Plans to adopt <strong>in</strong> the next year<br />

10%<br />

No plans to adopt<br />

42%<br />

Adopted<br />

48%<br />

(n=156)<br />

4%