2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44 <strong>Aon</strong> Hewitt<br />

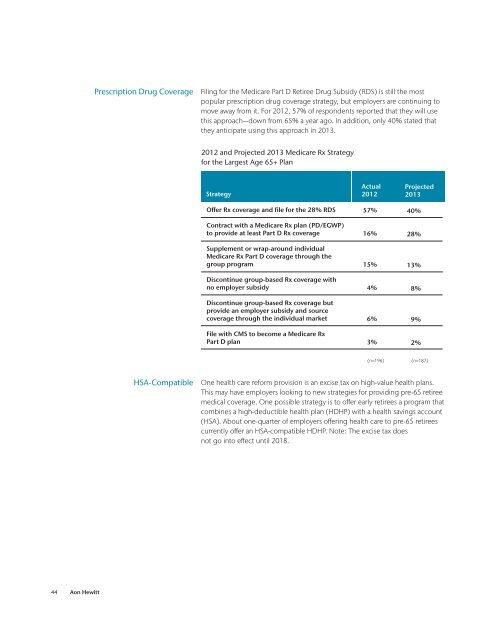

Prescription Drug Coverage Fil<strong>in</strong>g for the Medicare Part D Retiree Drug Subsidy (RDS) is still the most<br />

popular prescription drug coverage strategy, but employers are cont<strong>in</strong>u<strong>in</strong>g to<br />

move away from it. For <strong>2012</strong>, 57% of respondents reported that they will use<br />

this approach—down from 65% a year ago. In addition, only 40% stated that<br />

they anticipate us<strong>in</strong>g this approach <strong>in</strong> 2013.<br />

<strong>2012</strong> and Projected 2013 Medicare Rx Strategy<br />

for the Largest Age 65+ Plan<br />

Strategy<br />

O�er Rx coverage and file for the 28% RDS<br />

Contract with a Medicare Rx plan (PD/EGWP)<br />

to provide at least Part D Rx coverage<br />

Supplement or wrap-around <strong>in</strong>dividual<br />

Medicare Rx Part D coverage through the<br />

group program<br />

Discont<strong>in</strong>ue group-based Rx coverage with<br />

no employer subsidy<br />

Discont<strong>in</strong>ue group-based Rx coverage but<br />

provide an employer subsidy and source<br />

coverage through the <strong>in</strong>dividual market<br />

File with CMS to become a Medicare Rx<br />

Part D plan<br />

Actual<br />

<strong>2012</strong><br />

57%<br />

16%<br />

15%<br />

4%<br />

6%<br />

3%<br />

Projected<br />

2013<br />

40%<br />

28%<br />

13%<br />

8%<br />

9%<br />

2%<br />

(n=196) (n=187)<br />

HSA-Compatible One health care reform provision is an excise tax on high-value health plans.<br />

This may have employers look<strong>in</strong>g to new strategies for provid<strong>in</strong>g pre-65 retiree<br />

medical coverage. One possible strategy is to o�er early retirees a program that<br />

comb<strong>in</strong>es a high-deductible health plan (HDHP) with a health sav<strong>in</strong>gs account<br />

(HSA). About one-quarter of employers o�er<strong>in</strong>g health care to pre-65 retirees<br />

currently o�er an HSA-compatible HDHP. Note: The excise tax does<br />

not go <strong>in</strong>to e�ect until 2018.