2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

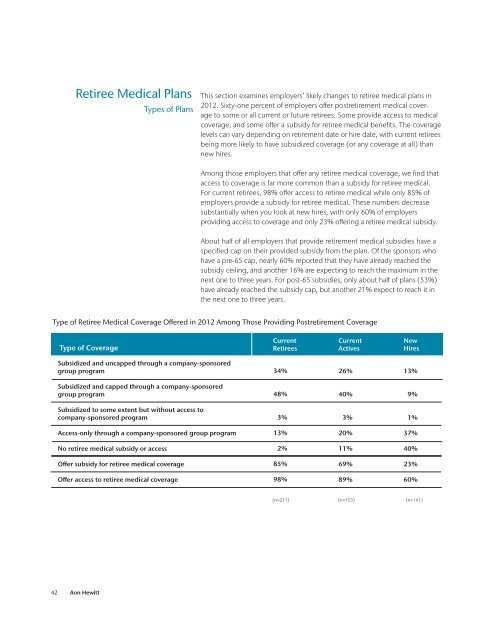

Retiree Medical Plans<br />

Types of Plans<br />

This section exam<strong>in</strong>es employers’ likely changes to retiree medical plans <strong>in</strong><br />

<strong>2012</strong>. Sixty-one percent of employers o�er postretirement medical coverage<br />

to some or all current or future retirees. Some provide access to medical<br />

coverage, and some o�er a subsidy for retiree medical benefits. The coverage<br />

levels can vary depend<strong>in</strong>g on retirement date or hire date, with current retirees<br />

be<strong>in</strong>g more likely to have subsidized coverage (or any coverage at all) than<br />

new hires.<br />

Among those employers that o�er any retiree medical coverage, we f<strong>in</strong>d that<br />

access to coverage is far more common than a subsidy for retiree medical.<br />

For current retirees, 98% o�er access to retiree medical while only 85% of<br />

employers provide a subsidy for retiree medical. These numbers decrease<br />

substantially when you look at new hires, with only 60% of employers<br />

provid<strong>in</strong>g access to coverage and only 23% o�er<strong>in</strong>g a retiree medical subsidy.<br />

About half of all employers that provide retirement medical subsidies have a<br />

specified cap on their provided subsidy from the plan. Of the sponsors who<br />

have a pre-65 cap, nearly 60% reported that they have already reached the<br />

subsidy ceil<strong>in</strong>g, and another 16% are expect<strong>in</strong>g to reach the maximum <strong>in</strong> the<br />

next one to three years. For post-65 subsidies, only about half of plans (53%)<br />

have already reached the subsidy cap, but another 21% expect to reach it <strong>in</strong><br />

the next one to three years.<br />

Type of Retiree Medical Coverage O�ered <strong>in</strong> <strong>2012</strong> Among Those Provid<strong>in</strong>g Postretirement Coverage<br />

Type of Coverage<br />

Subsidized and uncapped through a company-sponsored<br />

group program<br />

Subsidized and capped through a company-sponsored<br />

group program<br />

Subsidized to some extent but without access to<br />

company-sponsored program<br />

Access-only through a company-sponsored group program<br />

No retiree medical subsidy or access<br />

O�er subsidy for retiree medical coverage<br />

O�er access to retiree medical coverage<br />

42 <strong>Aon</strong> Hewitt<br />

Current<br />

Retirees<br />

34%<br />

48%<br />

3%<br />

13%<br />

2%<br />

85%<br />

98%<br />

Current<br />

Actives<br />

26%<br />

40%<br />

3%<br />

20%<br />

11%<br />

69%<br />

89%<br />

New<br />

Hires<br />

13%<br />

9%<br />

1%<br />

37%<br />

40%<br />

23%<br />

60%<br />

(n=211) (n=153) (n=141)