2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

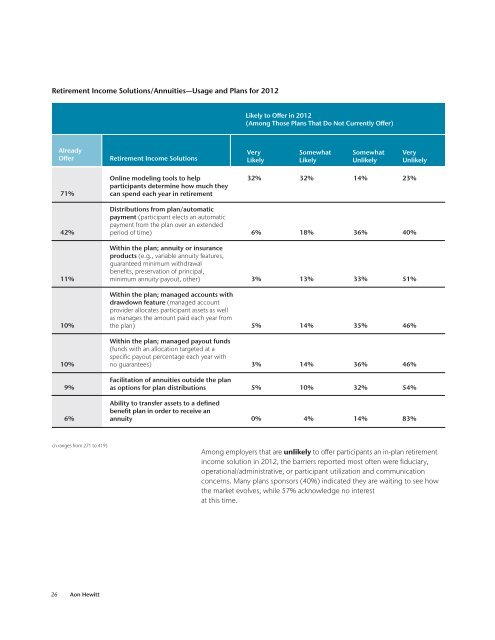

<strong>Retirement</strong> Income Solutions/Annuities—Usage and Plans for <strong>2012</strong><br />

Already<br />

O�er <strong>Retirement</strong> Income Solutions<br />

71%<br />

42%<br />

11%<br />

10%<br />

10%<br />

9%<br />

6%<br />

(n ranges from 271 to 419)<br />

26 <strong>Aon</strong> Hewitt<br />

Onl<strong>in</strong>e model<strong>in</strong>g tools to help<br />

participants determ<strong>in</strong>e how much they<br />

can spend each year <strong>in</strong> retirement<br />

Distributions from plan/automatic<br />

payment (participant elects an automatic<br />

payment from the plan over an extended<br />

period of time)<br />

With<strong>in</strong> the plan; annuity or <strong>in</strong>surance<br />

products (e.g., variable annuity features,<br />

guaranteed m<strong>in</strong>imum withdrawal<br />

benefits, preservation of pr<strong>in</strong>cipal,<br />

m<strong>in</strong>imum annuity payout, other)<br />

With<strong>in</strong> the plan; managed accounts with<br />

drawdown feature (managed account<br />

provider allocates participant assets as well<br />

as manages the amount paid each year from<br />

the plan)<br />

With<strong>in</strong> the plan; managed payout funds<br />

(funds with an allocation targeted at a<br />

specific payout percentage each year with<br />

no guarantees)<br />

Facilitation of annuities outside the plan<br />

as options for plan distributions<br />

Ability to transfer assets to a def<strong>in</strong>ed<br />

benefit plan <strong>in</strong> order to receive an<br />

annuity<br />

Likely to O�er <strong>in</strong> <strong>2012</strong><br />

(Among Those Plans That Do Not Currently O�er)<br />

Very<br />

Likely<br />

32%<br />

6%<br />

3%<br />

5%<br />

3%<br />

5%<br />

0%<br />

Somewhat<br />

Likely<br />

32%<br />

18%<br />

13%<br />

14%<br />

14%<br />

10%<br />

4%<br />

Somewhat<br />

Unlikely<br />

14%<br />

36%<br />

33%<br />

35%<br />

36%<br />

32%<br />

14%<br />

Very<br />

Unlikely<br />

23%<br />

40%<br />

51%<br />

46%<br />

46%<br />

54%<br />

83%<br />

Among employers that are unlikely to o�er participants an <strong>in</strong>-plan retirement<br />

<strong>in</strong>come solution <strong>in</strong> <strong>2012</strong>, the barriers reported most often were fiduciary,<br />

operational/adm<strong>in</strong>istrative, or participant utilization and communication<br />

concerns. Many plans sponsors (40%) <strong>in</strong>dicated they are wait<strong>in</strong>g to see how<br />

the market evolves, while 57% acknowledge no <strong>in</strong>terest<br />

at this time.