2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

2012 Hot Topics in Retirement - Aon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46 <strong>Aon</strong> Hewitt<br />

Likely Changes Projected<br />

<strong>in</strong> 2013<br />

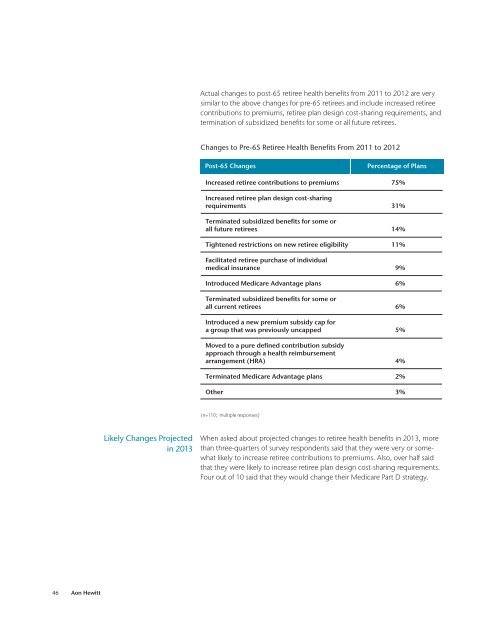

Actual changes to post-65 retiree health benefits from 2011 to <strong>2012</strong> are very<br />

similar to the above changes for pre-65 retirees and <strong>in</strong>clude <strong>in</strong>creased retiree<br />

contributions to premiums, retiree plan design cost-shar<strong>in</strong>g requirements, and<br />

term<strong>in</strong>ation of subsidized benefits for some or all future retirees.<br />

Changes to Pre-65 Retiree Health Benefits From 2011 to <strong>2012</strong><br />

Post-65 Changes<br />

Increased retiree contributions to premiums<br />

Increased retiree plan design cost-shar<strong>in</strong>g<br />

requirements<br />

Term<strong>in</strong>ated subsidized benefits for some or<br />

all future retirees<br />

Tightened restrictions on new retiree eligibility<br />

Facilitated retiree purchase of <strong>in</strong>dividual<br />

medical <strong>in</strong>surance<br />

Introduced Medicare Advantage plans<br />

Term<strong>in</strong>ated subsidized benefits for some or<br />

all current retirees<br />

Introduced a new premium subsidy cap for<br />

a group that was previously uncapped<br />

Moved to a pure def<strong>in</strong>ed contribution subsidy<br />

approach through a health reimbursement<br />

arrangement (HRA)<br />

Term<strong>in</strong>ated Medicare Advantage plans<br />

Other<br />

(n=110; multiple responses)<br />

Percentage of Plans<br />

75%<br />

31%<br />

14%<br />

11%<br />

When asked about projected changes to retiree health benefits <strong>in</strong> 2013, more<br />

than three-quarters of survey respondents said that they were very or somewhat<br />

likely to <strong>in</strong>crease retiree contributions to premiums. Also, over half said<br />

that they were likely to <strong>in</strong>crease retiree plan design cost-shar<strong>in</strong>g requirements.<br />

Four out of 10 said that they would change their Medicare Part D strategy.<br />

9%<br />

6%<br />

6%<br />

5%<br />

4%<br />

2%<br />

3%