Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

3.5 Annual Reports<br />

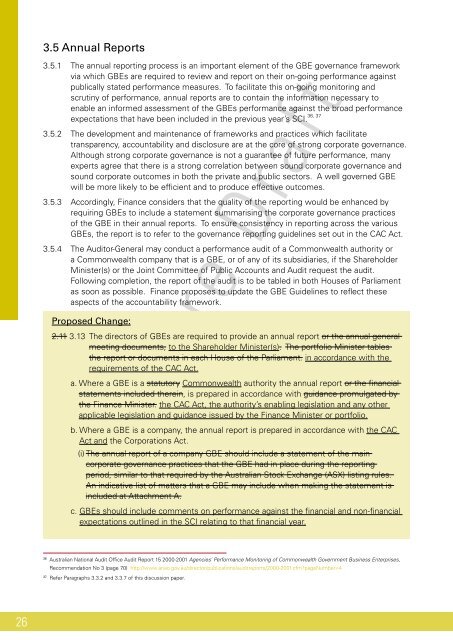

3.5.1 The annual reporting process is an important element <strong>of</strong> the GBE governance framework<br />

via which GBEs are required to review and report on their on-going performance against<br />

publically stated performance measures. To facilitate this on-going monitoring and<br />

scrutiny <strong>of</strong> performance, annual reports are to contain the information necessary to<br />

enable an informed assessment <strong>of</strong> the GBEs performance against the broad performance<br />

36, 37<br />

expectations that have been included in the previous year’s SCI.<br />

3.5.2 The development and maintenance <strong>of</strong> frameworks and practices which facilitate<br />

transparency, accountability and disclosure are at the core <strong>of</strong> strong corporate governance.<br />

Although strong corporate governance is not a guarantee <strong>of</strong> future performance, many<br />

experts agree that there is a strong correlation between sound corporate governance and<br />

sound corporate outcomes in both the private and public sectors. A well governed GBE<br />

will be more likely to be effcient and to produce effective outcomes.<br />

3.5.3 Accordingly, Finance considers that the quality <strong>of</strong> the reporting would be enhanced by<br />

requiring GBEs to include a statement summarising the corporate governance practices<br />

<strong>of</strong> the GBE in their annual reports. To ensure consistency in reporting across the various<br />

GBEs, the report is to refer to the governance reporting guidelines set out in the CAC Act.<br />

3.5.4 The Auditor-General may conduct a performance audit <strong>of</strong> a <strong>Commonwealth</strong> authority or<br />

a <strong>Commonwealth</strong> company that is a GBE, or <strong>of</strong> any <strong>of</strong> its subsidiaries, if the Shareholder<br />

Minister(s) or the Joint Committee <strong>of</strong> Public Accounts and Audit request the audit.<br />

Following completion, the report <strong>of</strong> the audit is to be tabled in both Houses <strong>of</strong> Parliament<br />

as soon as possible. Finance proposes to update the GBE Guidelines to refect these<br />

aspects <strong>of</strong> the accountability framework.<br />

Proposed Change:<br />

2.11 3.13 The directors <strong>of</strong> GBEs are required to provide an annual report or the annual general<br />

meeting documents, to the Shareholder Minister(s). The portfolio Minister tables<br />

the report or documents in each House <strong>of</strong> the Parliament. in accordance with the<br />

requirements <strong>of</strong> the CAC Act.<br />

a. Where a GBE is a statutory <strong>Commonwealth</strong> authority the annual report or the fnancial<br />

statements included therein, is prepared in accordance with guidance promulgated by<br />

the Finance Minister. the CAC Act, the authority’s enabling legislation and any other<br />

applicable legislation and guidance issued by the Finance Minister or portfolio.<br />

b. Where a GBE is a company, the annual report is prepared in accordance with the CAC<br />

Act and the Corporations Act.<br />

(i) The annual report <strong>of</strong> a company GBE should include a statement <strong>of</strong> the main<br />

corporate governance practices that the GBE had in place during the reporting<br />

period, similar to that required by the Australian Stock Exchange (ASX) listing rules.<br />

An indicative list <strong>of</strong> matters that a GBE may include when making the statement is<br />

included at Attachment A.<br />

Exposure Draft<br />

c. GBEs should include comments on performance against the fnancial and non-fnancial<br />

expectations outlined in the SCI relating to that fnancial year.<br />

36 Australian National Audit Offce Audit Report 15 2000-2001 Agencies’ Performance Monitoring <strong>of</strong> <strong>Commonwealth</strong> <strong>Government</strong> <strong>Business</strong> <strong>Enterprises</strong>,<br />

Recommendation No 3 (page 70) http://www.anao.gov.au/director/publications/auditreports/2000-2001.cfm?pageNumber=4<br />

37 Refer Paragraphs 3.3.2 and 3.3.7 <strong>of</strong> this discussion paper.