Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

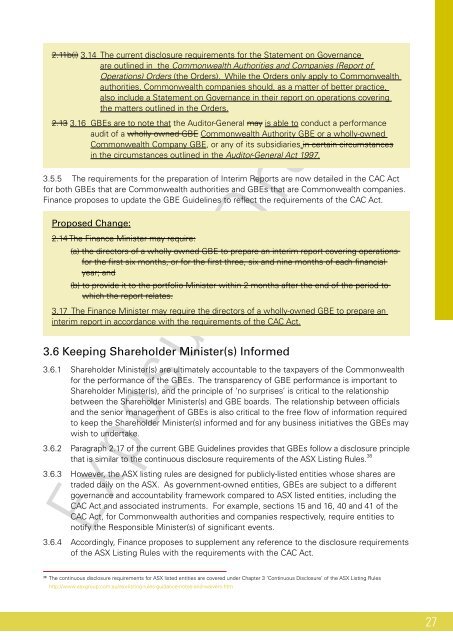

2.11b(i) 3.14 The current disclosure requirements for the Statement on Governance<br />

are outlined in the <strong>Commonwealth</strong> Authorities and Companies (Report <strong>of</strong><br />

Operations) Orders (the Orders). While the Orders only apply to <strong>Commonwealth</strong><br />

authorities, <strong>Commonwealth</strong> companies should, as a matter <strong>of</strong> better practice,<br />

also include a Statement on Governance in their report on operations covering<br />

the matters outlined in the Orders.<br />

2.13 3.16 GBEs are to note that the Auditor-General may is able to conduct a performance<br />

audit <strong>of</strong> a wholly owned GBE <strong>Commonwealth</strong> Authority GBE or a wholly-owned<br />

<strong>Commonwealth</strong> Company GBE, or any <strong>of</strong> its subsidiaries in certain circumstances<br />

in the circumstances outlined in the Auditor-General Act 1997.<br />

3.5.5 The requirements for the preparation <strong>of</strong> Interim Reports are now detailed in the CAC Act<br />

for both GBEs that are <strong>Commonwealth</strong> authorities and GBEs that are <strong>Commonwealth</strong> companies.<br />

Finance proposes to update the GBE Guidelines to refect the requirements <strong>of</strong> the CAC Act.<br />

Proposed Change:<br />

2.14 The Finance Minister may require:<br />

(a) the directors <strong>of</strong> a wholly owned GBE to prepare an interim report covering operations<br />

for the frst six months, or for the frst three, six and nine months <strong>of</strong> each fnancial<br />

year; and<br />

(b) to provide it to the portfolio Minister within 2 months after the end <strong>of</strong> the period to<br />

which the report relates.<br />

3.17 The Finance Minister may require the directors <strong>of</strong> a wholly-owned GBE to prepare an<br />

interim report in accordance with the requirements <strong>of</strong> the CAC Act.<br />

3.6 Keeping Shareholder Minister(s) Informed<br />

3.6.1 Shareholder Minister(s) are ultimately accountable to the taxpayers <strong>of</strong> the <strong>Commonwealth</strong><br />

for the performance <strong>of</strong> the GBEs. The transparency <strong>of</strong> GBE performance is important to<br />

Shareholder Minister(s), and the principle <strong>of</strong> ‘no surprises’ is critical to the relationship<br />

between the Shareholder Minister(s) and GBE boards. The relationship between <strong>of</strong>fcials<br />

and the senior management <strong>of</strong> GBEs is also critical to the free fow <strong>of</strong> information required<br />

to keep the Shareholder Minister(s) informed and for any business initiatives the GBEs may<br />

wish to undertake.<br />

3.6.2 Paragraph 2.17 <strong>of</strong> the current GBE Guidelines provides that GBEs follow a disclosure principle<br />

that is similar to the continuous disclosure requirements <strong>of</strong> the ASX Listing Rules. 38<br />

3.6.3 However, the ASX listing rules are designed for publicly-listed entities whose shares are<br />

traded daily on the ASX. As government-owned entities, GBEs are subject to a different<br />

governance and accountability framework compared to ASX listed entities, including the<br />

CAC Act and associated instruments. For example, sections 15 and 16, 40 and 41 <strong>of</strong> the<br />

CAC Act, for <strong>Commonwealth</strong> authorities and companies respectively, require entities to<br />

notify the Responsible Minister(s) <strong>of</strong> signifcant events.<br />

Exposure Draft<br />

3.6.4 Accordingly, Finance proposes to supplement any reference to the disclosure requirements<br />

<strong>of</strong> the ASX Listing Rules with the requirements with the CAC Act.<br />

38 The continuous disclosure requirements for ASX listed entities are covered under Chapter 3 ‘Continuous Disclosure’ <strong>of</strong> the ASX Listing Rules<br />

http://www.asxgroup.com.au/asx-listing-rules-guidance-notes-and-waivers.htm<br />

27