Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

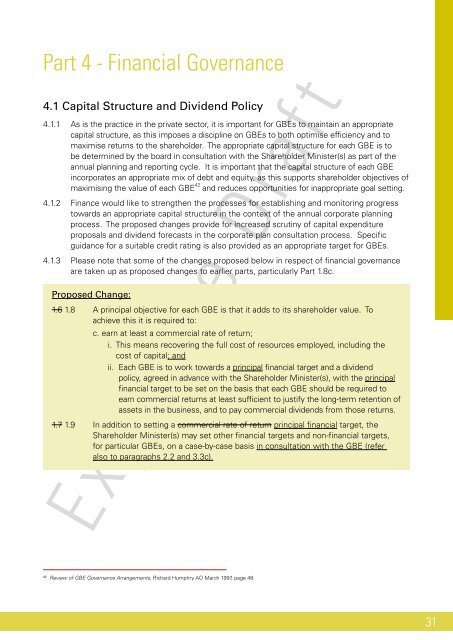

Part 4 - Financial Governance<br />

4.1 Capital Structure and Dividend Policy<br />

4.1.1 As is the practice in the private sector, it is important for GBEs to maintain an appropriate<br />

capital structure, as this imposes a discipline on GBEs to both optimise effciency and to<br />

maximise returns to the shareholder. The appropriate capital structure for each GBE is to<br />

be determined by the board in consultation with the Shareholder Minister(s) as part <strong>of</strong> the<br />

annual planning and reporting cycle. It is important that the capital structure <strong>of</strong> each GBE<br />

incorporates an appropriate mix <strong>of</strong> debt and equity, as this supports shareholder objectives <strong>of</strong><br />

maximising the value <strong>of</strong> each GBE 42 and reduces opportunities for inappropriate goal setting.<br />

4.1.2 Finance would like to strengthen the processes for establishing and monitoring progress<br />

towards an appropriate capital structure in the context <strong>of</strong> the annual corporate planning<br />

process. The proposed changes provide for increased scrutiny <strong>of</strong> capital expenditure<br />

proposals and dividend forecasts in the corporate plan consultation process. Specifc<br />

guidance for a suitable credit rating is also provided as an appropriate target for GBEs.<br />

4.1.3 Please note that some <strong>of</strong> the changes proposed below in respect <strong>of</strong> fnancial governance<br />

are taken up as proposed changes to earlier parts, particularly Part 1.8c.<br />

Proposed Change:<br />

1.6 1.8 A principal objective for each GBE is that it adds to its shareholder value. To<br />

achieve this it is required to:<br />

c. earn at least a commercial rate <strong>of</strong> return;<br />

i. This means recovering the full cost <strong>of</strong> resources employed, including the<br />

cost <strong>of</strong> capital; and<br />

ii. Each GBE is to work towards a principal fnancial target and a dividend<br />

policy, agreed in advance with the Shareholder Minister(s), with the principal<br />

fnancial target to be set on the basis that each GBE should be required to<br />

earn commercial returns at least suffcient to justify the long-term retention <strong>of</strong><br />

assets in the business, and to pay commercial dividends from those returns.<br />

1.7 1.9 In addition to setting a commercial rate <strong>of</strong> return principal fnancial target, the<br />

Shareholder Minister(s) may set other fnancial targets and non-fnancial targets,<br />

for particular GBEs, on a case-by-case basis in consultation with the GBE (refer<br />

also to paragraphs 2.2 and 3.3c).<br />

Exposure Draft<br />

42 <strong>Review</strong> <strong>of</strong> GBE Governance Arrangements, Richard Humphry AO March 1997, page 48.<br />

31