Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

Review of Commonwealth Government Business Enterprises ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

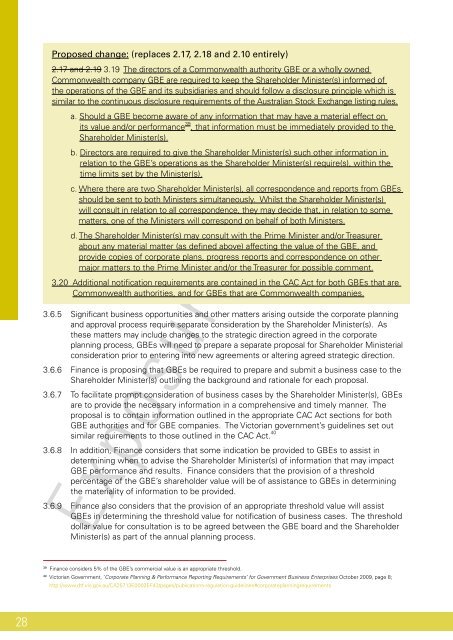

Proposed change: (replaces 2.17, 2.18 and 2.10 entirely)<br />

2.17 and 2.19 3.19 The directors <strong>of</strong> a <strong>Commonwealth</strong> authority GBE or a wholly owned<br />

<strong>Commonwealth</strong> company GBE are required to keep the Shareholder Minister(s) informed <strong>of</strong><br />

the operations <strong>of</strong> the GBE and its subsidiaries and should follow a disclosure principle which is<br />

similar to the continuous disclosure requirements <strong>of</strong> the Australian Stock Exchange listing rules.<br />

a. Should a GBE become aware <strong>of</strong> any information that may have a material effect on<br />

its value and/or performance 39 , that information must be immediately provided to the<br />

Shareholder Minister(s).<br />

b. Directors are required to give the Shareholder Minister(s) such other information in<br />

relation to the GBE’s operations as the Shareholder Minister(s) require(s), within the<br />

time limits set by the Minister(s).<br />

c. Where there are two Shareholder Minister(s), all correspondence and reports from GBEs<br />

should be sent to both Ministers simultaneously. Whilst the Shareholder Minister(s)<br />

will consult in relation to all correspondence, they may decide that, in relation to some<br />

matters, one <strong>of</strong> the Ministers will correspond on behalf <strong>of</strong> both Ministers.<br />

d. The Shareholder Minister(s) may consult with the Prime Minister and/or Treasurer<br />

about any material matter (as defned above) affecting the value <strong>of</strong> the GBE, and<br />

provide copies <strong>of</strong> corporate plans, progress reports and correspondence on other<br />

major matters to the Prime Minister and/or the Treasurer for possible comment.<br />

3.20 Additional notifcation requirements are contained in the CAC Act for both GBEs that are<br />

<strong>Commonwealth</strong> authorities, and for GBEs that are <strong>Commonwealth</strong> companies.<br />

3.6.5 Signifcant business opportunities and other matters arising outside the corporate planning<br />

and approval process require separate consideration by the Shareholder Minister(s). As<br />

these matters may include changes to the strategic direction agreed in the corporate<br />

planning process, GBEs will need to prepare a separate proposal for Shareholder Ministerial<br />

consideration prior to entering into new agreements or altering agreed strategic direction.<br />

3.6.6 Finance is proposing that GBEs be required to prepare and submit a business case to the<br />

Shareholder Minister(s) outlining the background and rationale for each proposal.<br />

3.6.7 To facilitate prompt consideration <strong>of</strong> business cases by the Shareholder Minister(s), GBEs<br />

are to provide the necessary information in a comprehensive and timely manner. The<br />

proposal is to contain information outlined in the appropriate CAC Act sections for both<br />

GBE authorities and for GBE companies. The Victorian government’s guidelines set out<br />

similar requirements to those outlined in the CAC Act. 40<br />

3.6.8 In addition, Finance considers that some indication be provided to GBEs to assist in<br />

determining when to advise the Shareholder Minister(s) <strong>of</strong> information that may impact<br />

GBE performance and results. Finance considers that the provision <strong>of</strong> a threshold<br />

percentage <strong>of</strong> the GBE’s shareholder value will be <strong>of</strong> assistance to GBEs in determining<br />

the materiality <strong>of</strong> information to be provided.<br />

3.6.9 Finance also considers that the provision <strong>of</strong> an appropriate threshold value will assist<br />

GBEs in determining the threshold value for notifcation <strong>of</strong> business cases. The threshold<br />

dollar value for consultation is to be agreed between the GBE board and the Shareholder<br />

Minister(s) as part <strong>of</strong> the annual planning process.<br />

Exposure Draft<br />

39 Finance considers 5% <strong>of</strong> the GBE’s commercial value is an appropriate threshold.<br />

40 Victorian <strong>Government</strong>, ‘Corporate Planning & Performance Reporting Requirements’ for <strong>Government</strong> <strong>Business</strong> <strong>Enterprises</strong> October 2009, page 8;<br />

http://www.dtf.vic.gov.au/CA25713E0002EF43/pages/publications-regulation-guidelines#corporateplanningrequirements