Community-based Sectors for the New England Groundfish Fishery

Community-based Sectors for the New England Groundfish Fishery

Community-based Sectors for the New England Groundfish Fishery

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

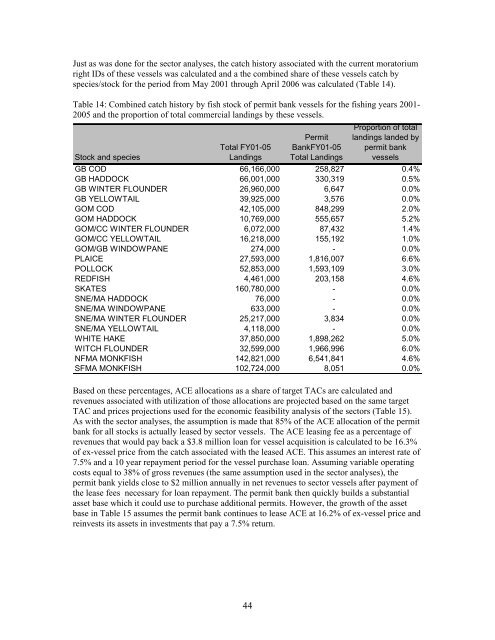

Just as was done <strong>for</strong> <strong>the</strong> sector analyses, <strong>the</strong> catch history associated with <strong>the</strong> current moratorium<br />

right IDs of <strong>the</strong>se vessels was calculated and a <strong>the</strong> combined share of <strong>the</strong>se vessels catch by<br />

species/stock <strong>for</strong> <strong>the</strong> period from May 2001 through April 2006 was calculated (Table 14).<br />

Table 14: Combined catch history by fish stock of permit bank vessels <strong>for</strong> <strong>the</strong> fishing years 2001-<br />

2005 and <strong>the</strong> proportion of total commercial landings by <strong>the</strong>se vessels.<br />

Stock and species<br />

Total FY01-05<br />

Landings<br />

Permit<br />

BankFY01-05<br />

Total Landings<br />

Proportion of total<br />

landings landed by<br />

permit bank<br />

vessels<br />

GB COD 66,166,000 258,827 0.4%<br />

GB HADDOCK 66,001,000 330,319 0.5%<br />

GB WINTER FLOUNDER 26,960,000 6,647 0.0%<br />

GB YELLOWTAIL 39,925,000 3,576 0.0%<br />

GOM COD 42,105,000 848,299 2.0%<br />

GOM HADDOCK 10,769,000 555,657 5.2%<br />

GOM/CC WINTER FLOUNDER 6,072,000 87,432 1.4%<br />

GOM/CC YELLOWTAIL 16,218,000 155,192 1.0%<br />

GOM/GB WINDOWPANE 274,000 - 0.0%<br />

PLAICE 27,593,000 1,816,007 6.6%<br />

POLLOCK 52,853,000 1,593,109 3.0%<br />

REDFISH 4,461,000 203,158 4.6%<br />

SKATES 160,780,000 - 0.0%<br />

SNE/MA HADDOCK 76,000 - 0.0%<br />

SNE/MA WINDOWPANE 633,000 - 0.0%<br />

SNE/MA WINTER FLOUNDER 25,217,000 3,834 0.0%<br />

SNE/MA YELLOWTAIL 4,118,000 - 0.0%<br />

WHITE HAKE 37,850,000 1,898,262 5.0%<br />

WITCH FLOUNDER 32,599,000 1,966,996 6.0%<br />

NFMA MONKFISH 142,821,000 6,541,841 4.6%<br />

SFMA MONKFISH 102,724,000 8,051 0.0%<br />

Based on <strong>the</strong>se percentages, ACE allocations as a share of target TACs are calculated and<br />

revenues associated with utilization of those allocations are projected <strong>based</strong> on <strong>the</strong> same target<br />

TAC and prices projections used <strong>for</strong> <strong>the</strong> economic feasibility analysis of <strong>the</strong> sectors (Table 15).<br />

As with <strong>the</strong> sector analyses, <strong>the</strong> assumption is made that 85% of <strong>the</strong> ACE allocation of <strong>the</strong> permit<br />

bank <strong>for</strong> all stocks is actually leased by sector vessels. The ACE leasing fee as a percentage of<br />

revenues that would pay back a $3.8 million loan <strong>for</strong> vessel acquisition is calculated to be 16.3%<br />

of ex-vessel price from <strong>the</strong> catch associated with <strong>the</strong> leased ACE. This assumes an interest rate of<br />

7.5% and a 10 year repayment period <strong>for</strong> <strong>the</strong> vessel purchase loan. Assuming variable operating<br />

costs equal to 38% of gross revenues (<strong>the</strong> same assumption used in <strong>the</strong> sector analyses), <strong>the</strong><br />

permit bank yields close to $2 million annually in net revenues to sector vessels after payment of<br />

<strong>the</strong> lease fees necessary <strong>for</strong> loan repayment. The permit bank <strong>the</strong>n quickly builds a substantial<br />

asset base which it could use to purchase additional permits. However, <strong>the</strong> growth of <strong>the</strong> asset<br />

base in Table 15 assumes <strong>the</strong> permit bank continues to lease ACE at 16.2% of ex-vessel price and<br />

reinvests its assets in investments that pay a 7.5% return.<br />

44