Annual report 2001 - GL events

Annual report 2001 - GL events

Annual report 2001 - GL events

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

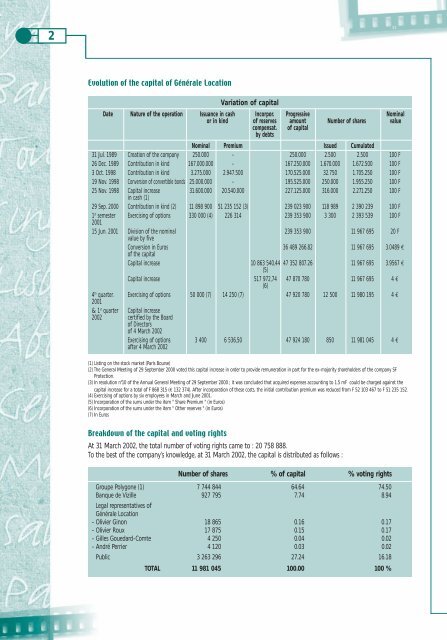

Evolution of the capital of Générale Location<br />

Variation of capital<br />

Date Nature of the operation Issuance in cash Incorpor. Progressive Nominal<br />

or in kind of reserves amount Number of shares value<br />

compensat. of capital<br />

by debts<br />

Nominal Premium Issued Cumulated<br />

31 Jul. 1989 Creation of the company 250.000 - 250.000 2.500 2.500 100 F<br />

26 Dec. 1989 Contribution in kind 167.000.000 - 167.250.000 1.670.000 1.672.500 100 F<br />

3 Oct. 1998 Contribution in kind 3.275.000 2.947.500 170.525.000 32.750 1.705.250 100 F<br />

19 Nov. 1998 Conversion of convertible bonds 25.000.000 - 195.525.000 250.000 1.955.250 100 F<br />

25 Nov. 1998 Capital increase 31.600.000 20.540.000 227.125.000 316.000 2.271.250 100 F<br />

in cash (1)<br />

29 Sep. 2000 Contribution in kind (2) 11 898 900 51 235 152 (3) 239 023 900 118 989 2 390 239 100 F<br />

1 st semester Exercising of options 330 000 (4) 226 314 239 353 900 3 300 2 393 539 100 F<br />

<strong>2001</strong><br />

15 Jun. <strong>2001</strong> Division of the nominal 239 353 900 11 967 695 20 F<br />

value by five<br />

Conversion in Euros 36 489 266.82 11 967 695 3.0489 €<br />

of the capital<br />

Capital increase 10 863 540,44 47 352 807.26 11 967 695 3.9567 €<br />

(5)<br />

Capital increase 517 972,74 47 870 780 11 967 695 4 €<br />

(6)<br />

4 th quarter. Exercising of options 50 000 (7) 14 250 (7) 47 920 780 12 500 11 980 195 4 €<br />

<strong>2001</strong><br />

& 1 st quarter Capital increase<br />

2002 certified by the Board<br />

of Directors<br />

of 4 March 2002<br />

Exercising of options 3 400 6 536,50 47 924 180 850 11 981 045 4 €<br />

after 4 March 2002<br />

(1) Listing on the stock market (Paris Bourse)<br />

(2) The General Meeting of 29 September 2000 voted this capital increase in order to provide remuneration in part for the ex-majority shareholders of the company SF<br />

Protection.<br />

(3) In resolution n°10 of the <strong>Annual</strong> General Meeting of 29 September 2000 ; it was concluded that acquired expenses accounting to 1.5 mF could be charged against the<br />

capital increase for a total of F 868 315 (€ 132 374). After incorporation of these costs, the initial contribution premium was reduced from F 52 103 467 to F 51 235 152.<br />

(4) Exercising of options by six employees in March and June <strong>2001</strong>.<br />

(5) Incorporation of the sums under the item " Share Premium " (in Euros)<br />

(6) Incorporation of the sums under the item " Other reserves " (in Euros)<br />

(7) In Euros<br />

Breakdown of the capital and voting rights<br />

At 31 March 2002, the total number of voting rights came to : 20 758 888.<br />

To the best of the company’s knowledge, at 31 March 2002, the capital is distributed as follows :<br />

Number of shares % of capital % voting rights<br />

Groupe Polygone (1) 7 744 844 64.64 74.50<br />

Banque de Vizille 927 795 7.74 8.94<br />

Legal representatives of<br />

Générale Location<br />

- Olivier Ginon 18 865 0.16 0.17<br />

- Olivier Roux 17 875 0.15 0.17<br />

- Gilles Gouedard-Comte 4 250 0.04 0.02<br />

- André Perrier 4 120 0.03 0.02<br />

Public 3 263 296 27.24 16.18<br />

TOTAL 11 981 045 100.00 100 %