Annual report 2001 - GL events

Annual report 2001 - GL events

Annual report 2001 - GL events

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

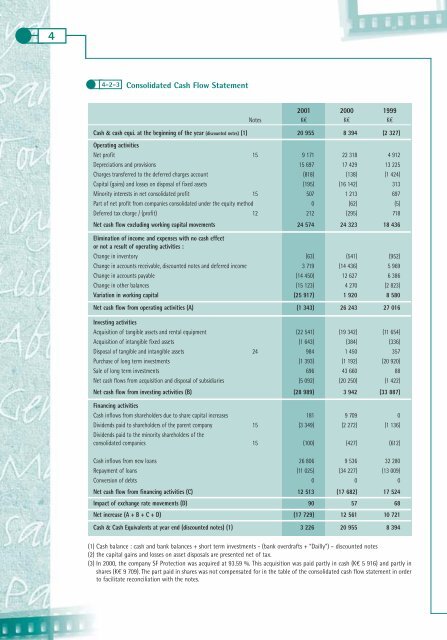

4-2-3 Consolidated Cash Flow Statement<br />

<strong>2001</strong> 2000 1999<br />

Notes K€ K€ K€<br />

Cash & cash equi. at the beginning of the year (discounted notes) (1) 20 955 8 394 (2 327)<br />

Operating activities<br />

Net profit 15 9 171 22 318 4 912<br />

Depreciations and provisions 15 697 17 429 13 225<br />

Charges transferred to the deferred charges account (818) (138) (1 424)<br />

Capital (gains) and losses on disposal of fixed assets (195) (16 142) 313<br />

Minority interests in net consolidated profit 15 507 1 213 697<br />

Part of net profit from companies consolidated under the equity method 0 (62) (5)<br />

Deferred tax charge / (profit) 12 212 (295) 718<br />

Net cash flow excluding working capital movements 24 574 24 323 18 436<br />

Elimination of income and expenses with no cash effect<br />

or not a result of operating activities :<br />

Change in inventory (63) (541) (952)<br />

Change in accounts receivable, discounted notes and deferred income 3 719 (14 436) 5 969<br />

Change in accounts payable (14 450) 12 627 6 386<br />

Change in other balances (15 123) 4 270 (2 823)<br />

Variation in working capital (25 917) 1 920 8 580<br />

Net cash flow from operating activities (A) (1 343) 26 243 27 016<br />

Investing activities<br />

Acquisition of tangible assets and rental equipment (22 541) (19 342) (11 654)<br />

Acquisition of intangible fixed assets (1 643) (384) (336)<br />

Disposal of tangible and intangible assets 24 984 1 450 357<br />

Purchase of long term investments (1 393) (1 192) (20 920)<br />

Sale of long term investments 696 43 660 88<br />

Net cash flows from acquisition and disposal of subsidiaries (5 092) (20 250) (1 422)<br />

Net cash flow from investing activities (B) (28 989) 3 942 (33 887)<br />

Financing activities<br />

Cash inflows from shareholders due to share capital increases 181 9 709 0<br />

Dividends paid to shareholders of the parent company 15 (3 349) (2 272) (1 136)<br />

Dividends paid to the minority shareholders of the<br />

consolidated companies 15 (100) (427) (612)<br />

Cash inflows from new loans 26 806 9 536 32 280<br />

Repayment of loans (11 025) (34 227) (13 009)<br />

Conversion of debts 0 0 0<br />

Net cash flow from financing activities (C) 12 513 (17 682) 17 524<br />

Impact of exchange rate movements (D) 90 57 68<br />

Net increase (A + B + C + D) (17 729) 12 561 10 721<br />

Cash & Cash Equivalents at year end (discounted notes) (1) 3 226 20 955 8 394<br />

(1) Cash balance : cash and bank balances + short term investments - (bank overdrafts + “Dailly”) – discounted notes<br />

(2) the capital gains and losses on asset disposals are presented net of tax.<br />

(3) In 2000, the company SF Protection was acquired at 93.59 %. This acquisition was paid partly in cash (K€ 5 916) and partly in<br />

shares (K€ 9 709). The part paid in shares was not compensated for in the table of the consolidated cash flow statement in order<br />

to facilitate reconciliation with the notes.