Annual report 2001 - GL events

Annual report 2001 - GL events

Annual report 2001 - GL events

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

66 67<br />

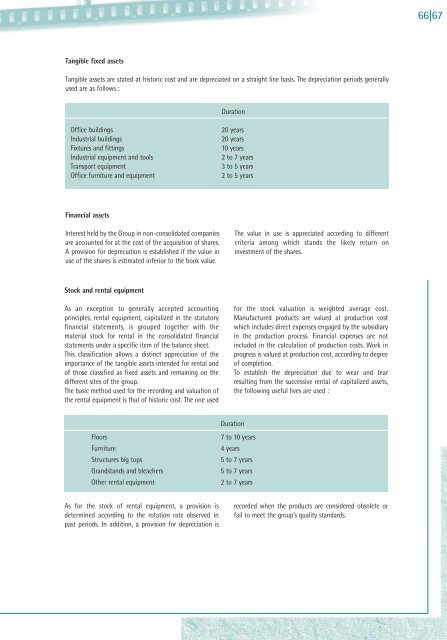

Tangible fixed assets<br />

Tangible assets are stated at historic cost and are depreciated on a straight line basis. The depreciation periods generally<br />

used are as follows :<br />

Duration<br />

Office buildings<br />

Industrial buildings<br />

Fixtures and fittings<br />

Industrial equipment and tools<br />

Transport equipment<br />

Office furniture and equipment<br />

20 years<br />

20 years<br />

10 years<br />

2 to 7 years<br />

3 to 5 years<br />

2 to 5 years<br />

Financial assets<br />

Interest held by the Group in non-consolidated companies<br />

are accounted for at the cost of the acquisition of shares.<br />

A provision for depreciation is established if the value in<br />

use of the shares is estimated inferior to the book value.<br />

The value in use is appreciated according to different<br />

criteria among which stands the likely return on<br />

investment of the shares.<br />

Stock and rental equipment<br />

As an exception to generally accepted accounting<br />

principles, rental equipment, capitalized in the statutory<br />

financial statements, is grouped together with the<br />

material stock for rental in the consolidated financial<br />

statements under a specific item of the balance sheet.<br />

This classification allows a distinct appreciation of the<br />

importance of the tangible assets intended for rental and<br />

of those classified as fixed assets and remaining on the<br />

different sites of the group.<br />

The basic method used for the recording and valuation of<br />

the rental equipment is that of historic cost. The one used<br />

for the stock valuation is weighted average cost.<br />

Manufactured products are valued at production cost<br />

which includes direct expenses engaged by the subsidiary<br />

in the production process. Financial expenses are not<br />

included in the calculation of production costs. Work in<br />

progress is valued at production cost, according to degree<br />

of completion.<br />

To establish the depreciation due to wear and tear<br />

resulting from the successive rental of capitalized assets,<br />

the following useful lives are used :<br />

Floors<br />

Furniture<br />

Structures big tops<br />

Grandstands and bleachers<br />

Other rental equipment<br />

Duration<br />

7 to 10 years<br />

4 years<br />

5 to 7 years<br />

5 to 7 years<br />

2 to 7 years<br />

As for the stock of rental equipment, a provision is<br />

determined according to the rotation rate observed in<br />

past periods. In addition, a provision for depreciation is<br />

recorded when the products are considered obsolete or<br />

fail to meet the group’s quality standards.