Annual report 2001 - GL events

Annual report 2001 - GL events

Annual report 2001 - GL events

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

48 49<br />

d - Exceptional profit / (loss<br />

This year the exceptional profit / (loss) reaches 98 K€. This<br />

amount includes principally the capital gain on the sale<br />

of real estate and the registered loss when material was<br />

shipped back from Sydney. As a reminder, the exceptional<br />

profit / (loss) for the year 2000 was particularly high<br />

considering the capital gain of K€ 23 033 on the Paris<br />

expo operation.<br />

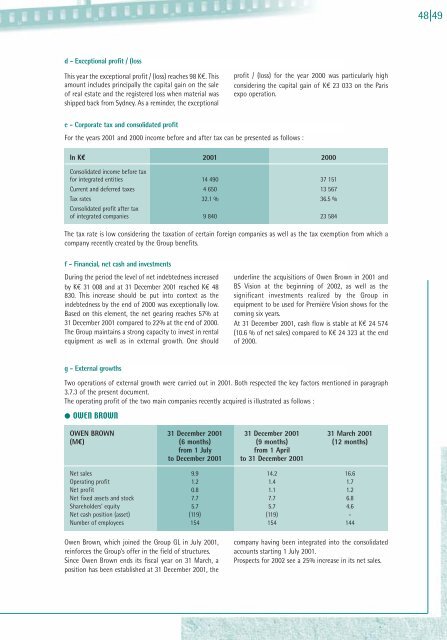

e - Corporate tax and consolidated profit<br />

For the years <strong>2001</strong> and 2000 income before and after tax can be presented as follows :<br />

In K€ <strong>2001</strong> 2000<br />

Consolidated income before tax<br />

for integrated entities 14 490 37 151<br />

Current and deferred taxes 4 650 13 567<br />

Tax rates 32.1 % 36.5 %<br />

Consolidated profit after tax<br />

of integrated companies 9 840 23 584<br />

The tax rate is low considering the taxation of certain foreign companies as well as the tax exemption from which a<br />

company recently created by the Group benefits.<br />

f - Financial, net cash and investments<br />

During the period the level of net indebtedness increased<br />

by K€ 31 008 and at 31 December <strong>2001</strong> reached K€ 48<br />

830. This increase should be put into context as the<br />

indebtedness by the end of 2000 was exceptionally low.<br />

Based on this element, the net gearing reaches 57% at<br />

31 December <strong>2001</strong> compared to 22% at the end of 2000.<br />

The Group maintains a strong capacity to invest in rental<br />

equipment as well as in external growth. One should<br />

underline the acquisitions of Owen Brown in <strong>2001</strong> and<br />

BS Vision at the beginning of 2002, as well as the<br />

significant investments realized by the Group in<br />

equipment to be used for Première Vision shows for the<br />

coming six years.<br />

At 31 December <strong>2001</strong>, cash flow is stable at K€ 24 574<br />

(10.6 % of net sales) compared to K€ 24 323 at the end<br />

of 2000.<br />

g - External growths<br />

Two operations of external growth were carried out in <strong>2001</strong>. Both respected the key factors mentioned in paragraph<br />

3.7.3 of the present document.<br />

The operating profit of the two main companies recently acquired is illustrated as follows :<br />

● OWEN BROWN<br />

OWEN BROWN 31 December <strong>2001</strong> 31 December <strong>2001</strong> 31 March <strong>2001</strong><br />

(M€) (6 months) (9 months) (12 months)<br />

from 1 July<br />

from 1 April<br />

to December <strong>2001</strong> to 31 December <strong>2001</strong><br />

Net sales 9.9 14.2 16.6<br />

Operating profit 1.2 1.4 1.7<br />

Net profit 0.8 1.1 1.2<br />

Net fixed assets and stock 7.7 7.7 6.8<br />

Shareholders‘ equity 5.7 5.7 4.6<br />

Net cash position (asset) (119) (119) -<br />

Number of employees 154 154 144<br />

Owen Brown, which joined the Group <strong>GL</strong> in July <strong>2001</strong>,<br />

reinforces the Group’s offer in the field of structures.<br />

Since Owen Brown ends its fiscal year on 31 March, a<br />

position has been established at 31 December <strong>2001</strong>, the<br />

company having been integrated into the consolidated<br />

accounts starting 1 July <strong>2001</strong>.<br />

Prospects for 2002 see a 25% increase in its net sales.