Annual report 2001 - GL events

Annual report 2001 - GL events

Annual report 2001 - GL events

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

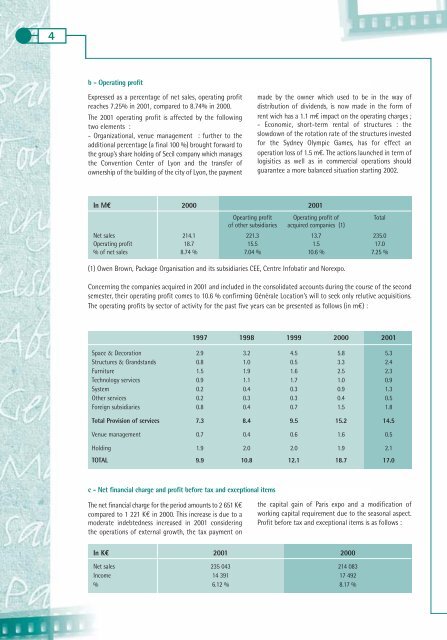

b - Operating profit<br />

Expressed as a percentage of net sales, operating profit<br />

reaches 7.25% in <strong>2001</strong>, compared to 8.74% in 2000.<br />

The <strong>2001</strong> operating profit is affected by the following<br />

two elements :<br />

- Organizational, venue management : further to the<br />

additional percentage (a final 100 %) brought forward to<br />

the group’s share holding of Secil company which manages<br />

the Convention Center of Lyon and the transfer of<br />

ownership of the building of the city of Lyon, the payment<br />

made by the owner which used to be in the way of<br />

distribution of dividends, is now made in the form of<br />

rent wich has a 1.1 m€ impact on the operating charges ;<br />

- Economic, short-term rental of structures : the<br />

slowdown of the rotation rate of the structures invested<br />

for the Sydney Olympic Games, has for effect an<br />

operation loss of 1.5 m€. The actions launched in term of<br />

logisitics as well as in commercial operations should<br />

guarantee a more balanced situation starting 2002.<br />

In M€ 2000 <strong>2001</strong><br />

Opearting profit Operating profit of Total<br />

of other subsidiaries acquired companies (1)<br />

Net sales 214.1 221.3 13.7 235.0<br />

Operating profit 18.7 15.5 1.5 17.0<br />

% of net sales 8.74 % 7.04 % 10.6 % 7.25 %<br />

(1) Owen Brown, Package Organisation and its subsidiaries CEE, Centre Infobatir and Norexpo.<br />

Concerning the companies acquired in <strong>2001</strong> and included in the consolidated accounts during the course of the second<br />

semester, their operating profit comes to 10.6 % confirming Générale Location’s will to seek only relutive acquisitions.<br />

The operating profits by sector of activity for the past five years can be presented as follows (in m€) :<br />

1997 1998 1999 2000 <strong>2001</strong><br />

Space & Decoration 2.9 3.2 4.5 5.8 5.3<br />

Structures & Grandstands 0.8 1.0 0.5 3.3 2.4<br />

Furniture 1.5 1.9 1.6 2.5 2.3<br />

Technology services 0.9 1.1 1.7 1.0 0.9<br />

System 0.2 0.4 0.3 0.9 1.3<br />

Other services 0.2 0.3 0.3 0.4 0.5<br />

Foreign subsidiaries 0.8 0.4 0.7 1.5 1.8<br />

Total Provision of services 7.3 8.4 9.5 15.2 14.5<br />

Venue management 0.7 0.4 0.6 1.6 0.5<br />

Holding 1.9 2.0 2.0 1.9 2.1<br />

TOTAL 9.9 10.8 12.1 18.7 17.0<br />

c - Net financial charge and profit before tax and exceptional items<br />

The net financial charge for the period amounts to 2 651 K€<br />

compared to 1 221 K€ in 2000. This increase is due to a<br />

moderate indebtedness increased in <strong>2001</strong> considering<br />

the operations of external growth, the tax payment on<br />

the capital gain of Paris expo and a modification of<br />

working capital requirement due to the seasonal aspect.<br />

Profit before tax and exceptional items is as follows :<br />

In K€ <strong>2001</strong> 2000<br />

Net sales 235 043 214 083<br />

Income 14 391 17 492<br />

% 6.12 % 8.17 %