3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

116<br />

Journal of Personal Finance<br />

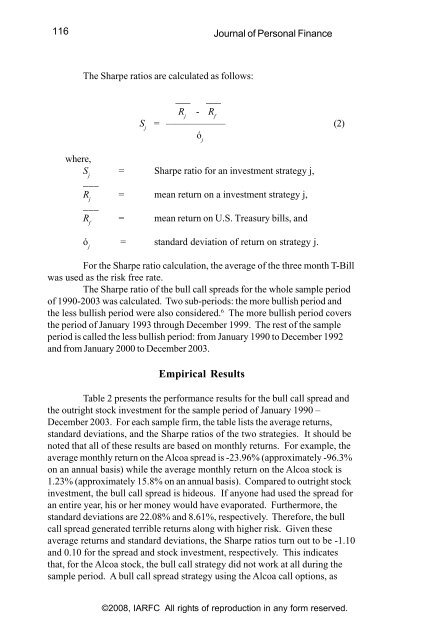

The Sharpe ratios are calculated as follows:<br />

___<br />

___<br />

R j<br />

- R f<br />

S j<br />

= —————— (2)<br />

ó j<br />

where,<br />

S j<br />

= Sharpe ratio for an investment strategy j,<br />

___<br />

R j<br />

= mean return on a investment strategy j,<br />

___<br />

R f<br />

= mean return on U.S. Treasury bills, and<br />

ó j<br />

= standard deviation of return on strategy j.<br />

For the Sharpe ratio calculation, the average of the three month T-Bill<br />

was used as the risk free rate.<br />

The Sharpe ratio of the bull call spreads for the whole sample period<br />

of 1990-2003 was calculated. Two sub-periods: the more bullish period and<br />

the less bullish period were also considered. 6 The more bullish period covers<br />

the period of January 1993 through December 1999. The rest of the sample<br />

period is called the less bullish period: from January 1990 to December 1992<br />

and from January 2000 to December 2003.<br />

Empirical Results<br />

Table 2 presents the performance results for the bull call spread and<br />

the outright stock investment for the sample period of January 1990 –<br />

December 2003. For each sample firm, the table lists the average returns,<br />

standard deviations, and the Sharpe ratios of the two strategies. It should be<br />

noted that all of these results are based on monthly returns. For example, the<br />

average monthly return on the Alcoa spread is -23.96% (approximately -96.3%<br />

on an annual basis) while the average monthly return on the Alcoa stock is<br />

1.23% (approximately 15.8% on an annual basis). Compared to outright stock<br />

investment, the bull call spread is hideous. If anyone had used the spread for<br />

an entire year, his or her money would have evaporated. Furthermore, the<br />

standard deviations are 22.08% and 8.61%, respectively. Therefore, the bull<br />

call spread generated terrible returns along with higher risk. Given these<br />

average returns and standard deviations, the Sharpe ratios turn out to be -1.10<br />

and 0.10 for the spread and stock investment, respectively. This indicates<br />

that, for the Alcoa stock, the bull call strategy did not work at all during the<br />

sample period. A bull call spread strategy using the Alcoa call options, as<br />

©2008, IARFC All rights of reproduction in any form reserved.