3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Volume 6, Issue 2 & 3 99<br />

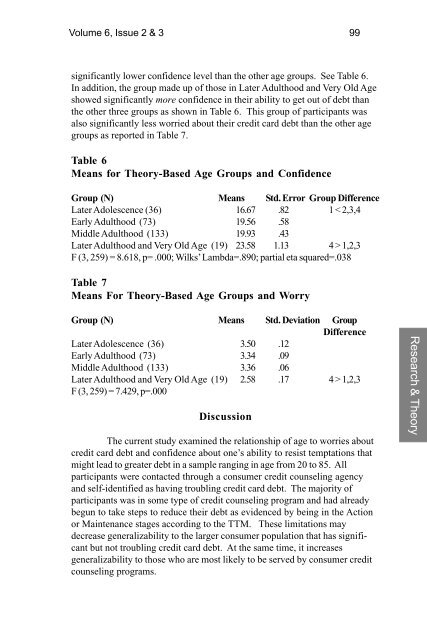

significantly lower confidence level than the other age groups. See Table 6.<br />

In addition, the group made up of those in Later Adulthood and Very Old Age<br />

showed significantly more confidence in their ability to get out of debt than<br />

the other three groups as shown in Table 6. This group of participants was<br />

also significantly less worried about their credit card debt than the other age<br />

groups as reported in Table 7.<br />

Table 6<br />

Means for Theory-Based Age Groups and Confidence<br />

Group (N) Means Std. Error Group Difference<br />

Later Adolescence (36) 16.67 .82 1 < 2,3,4<br />

Early Adulthood (73) 19.56 .58<br />

Middle Adulthood (133) 19.93 .43<br />

Later Adulthood and Very Old Age (19) 23.58 1.13 4 > 1,2,3<br />

F (3, 259) = 8.618, p= .000; Wilks’ Lambda=.890; partial eta squared=.038<br />

Table 7<br />

Means For Theory-Based Age Groups and Worry<br />

Group (N) Means Std. Deviation Group<br />

Difference<br />

Later Adolescence (36) 3.50 .12<br />

Early Adulthood (73) 3.34 .09<br />

Middle Adulthood (133) 3.36 .06<br />

Later Adulthood and Very Old Age (19) 2.58 .17 4 > 1,2,3<br />

F (3, 259) = 7.429, p=.000<br />

Discussion<br />

The current study examined the relationship of age to worries about<br />

credit card debt and confidence about one’s ability to resist temptations that<br />

might lead to greater debt in a sample ranging in age from 20 to 85. All<br />

participants were contacted through a consumer credit counseling agency<br />

and self-identified as having troubling credit card debt. The majority of<br />

participants was in some type of credit counseling program and had already<br />

begun to take steps to reduce their debt as evidenced by being in the Action<br />

or Maintenance stages according to the TTM. These limitations may<br />

decrease generalizability to the larger consumer population that has significant<br />

but not troubling credit card debt. At the same time, it increases<br />

generalizability to those who are most likely to be served by consumer credit<br />

counseling programs.<br />

Research & Theory