3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Volume 6, Issue 2 & 3 79<br />

asset allocations tend to overstate the withdrawal amount. The <strong>vol</strong>atility of<br />

the stock market implies that the odds of running out of money are about 50%<br />

if one withdraws the average expected rate per year. For a 30-year horizon,<br />

many portfolios allow a 4.5% real withdrawal rate with a failure probability of<br />

less than 10%, as evidenced in Cooley, Hubbard, and Walz (2003), Pye (2000),<br />

Ameriks, Veres, and Warshawsky (2001), Bengen (2001), and Tezel (2004).<br />

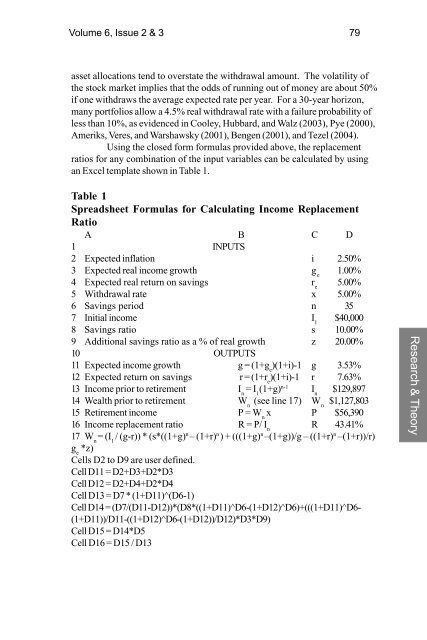

Using the closed form formulas provided above, the replacement<br />

ratios for any combination of the input variables can be calculated by using<br />

an Excel template shown in Table 1.<br />

Table 1<br />

Spreadsheet Formulas for Calculating Income Replacement<br />

Ratio<br />

A B C D<br />

1 INPUTS<br />

2 Expected inflation i 2.50%<br />

3 Expected real income growth g e<br />

1.00%<br />

4 Expected real return on savings r e<br />

5.00%<br />

5 Withdrawal rate x 5.00%<br />

6 Savings period n 35<br />

7 Initial income I 1<br />

$40,000<br />

8 Savings ratio s 10.00%<br />

9 Additional savings ratio as a % of real growth z 20.00%<br />

10 OUTPUTS<br />

11 Expected income growth g = (1+g e<br />

)(1+i)-1 g 3.53%<br />

12 Expected return on savings r = (1+r e<br />

)(1+i)-1 r 7.63%<br />

13 Income prior to retirement I n<br />

= I 1<br />

(1+g) n-1 I n<br />

$129,897<br />

14 Wealth prior to retirement W n<br />

(see line 17) W n<br />

$1,127,803<br />

15 Retirement income P = W n<br />

x P $56,390<br />

16 Income replacement ratio R = P/ I n<br />

R 43.41%<br />

17 W n<br />

= (I 1<br />

/ (g-r)) * (s*((1+g) n – (1+r) n ) + (((1+g) n –(1+g))/g – ((1+r) n –(1+r))/r)<br />

g e<br />

*z)<br />

Cells D2 to D9 are user defined.<br />

Cell D11 = D2+D3+D2*D3<br />

Cell D12 = D2+D4+D2*D4<br />

Cell D13 = D7 * (1+D11)^(D6-1)<br />

Cell D14 = (D7/(D11-D12))*(D8*((1+D11)^D6-(1+D12)^D6)+(((1+D11)^D6-<br />

(1+D11))/D11-((1+D12)^D6-(1+D12))/D12)*D3*D9)<br />

Cell D15 = D14*D5<br />

Cell D16 = D15 / D13<br />

Research & Theory