3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

Journal of Personal Finance<br />

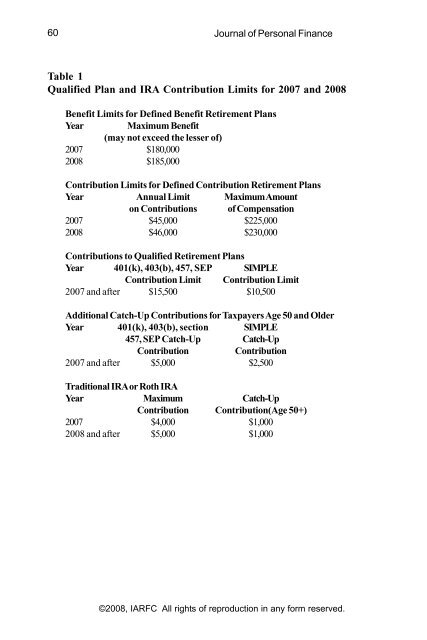

Table 1<br />

Qualified Plan and IRA Contribution Limits for 2007 and 2008<br />

Benefit Limits for Defined Benefit Retirement Plans<br />

Year Maximum Benefit<br />

(may not exceed the lesser of)<br />

2007 $180,000<br />

2008 $185,000<br />

Contribution Limits for Defined Contribution Retirement Plans<br />

Year Annual Limit Maximum Amount<br />

on Contributions of Compensation<br />

2007 $45,000 $225,000<br />

2008 $46,000 $230,000<br />

Contributions to Qualified Retirement Plans<br />

Year 401(k), 403(b), 457, SEP SIMPLE<br />

Contribution Limit Contribution Limit<br />

2007 and after $15,500 $10,500<br />

Additional Catch-Up Contributions for Taxpayers Age 50 and Older<br />

Year 401(k), 403(b), section SIMPLE<br />

457, SEP Catch-Up Catch-Up<br />

Contribution Contribution<br />

2007 and after $5,000 $2,500<br />

Traditional IRA or Roth IRA<br />

Year Maximum Catch-Up<br />

Contribution Contribution(Age 50+)<br />

2007 $4,000 $1,000<br />

2008 and after $5,000 $1,000<br />

©2008, IARFC All rights of reproduction in any form reserved.