3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

Journal of Personal Finance<br />

Illustrations<br />

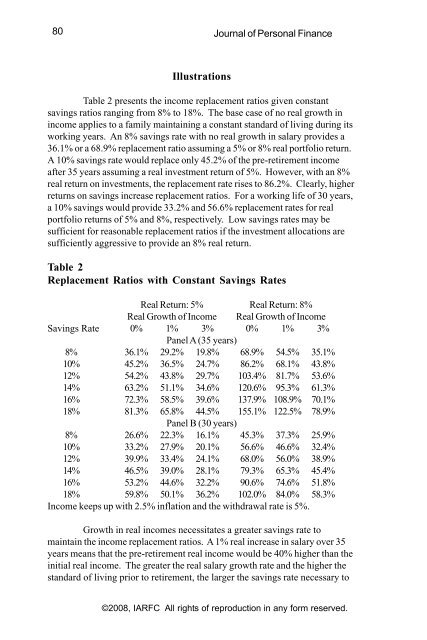

Table 2 presents the income replacement ratios given constant<br />

savings ratios ranging from 8% to 18%. The base case of no real growth in<br />

income applies to a family maintaining a constant standard of living during its<br />

working years. An 8% savings rate with no real growth in salary provides a<br />

36.1% or a 68.9% replacement ratio assuming a 5% or 8% real portfolio return.<br />

A 10% savings rate would replace only 45.2% of the pre-retirement income<br />

after 35 years assuming a real investment return of 5%. However, with an 8%<br />

real return on investments, the replacement rate rises to 86.2%. Clearly, higher<br />

returns on savings increase replacement ratios. For a working life of 30 years,<br />

a 10% savings would provide 33.2% and 56.6% replacement rates for real<br />

portfolio returns of 5% and 8%, respectively. Low savings rates may be<br />

sufficient for reasonable replacement ratios if the investment allocations are<br />

sufficiently aggressive to provide an 8% real return.<br />

Table 2<br />

Replacement Ratios with Constant Savings Rates<br />

Real Return: 5% Real Return: 8%<br />

Real Growth of Income Real Growth of Income<br />

Savings Rate 0% 1% 3% 0% 1% 3%<br />

Panel A (35 years)<br />

8% 36.1% 29.2% 19.8% 68.9% 54.5% 35.1%<br />

10% 45.2% 36.5% 24.7% 86.2% 68.1% 43.8%<br />

12% 54.2% 43.8% 29.7% 103.4% 81.7% 53.6%<br />

14% 63.2% 51.1% 34.6% 120.6% 95.3% 61.3%<br />

16% 72.3% 58.5% 39.6% 137.9% 108.9% 70.1%<br />

18% 81.3% 65.8% 44.5% 155.1% 122.5% 78.9%<br />

Panel B (30 years)<br />

8% 26.6% 22.3% 16.1% 45.3% 37.3% 25.9%<br />

10% 33.2% 27.9% 20.1% 56.6% 46.6% 32.4%<br />

12% 39.9% 33.4% 24.1% 68.0% 56.0% 38.9%<br />

14% 46.5% 39.0% 28.1% 79.3% 65.3% 45.4%<br />

16% 53.2% 44.6% 32.2% 90.6% 74.6% 51.8%<br />

18% 59.8% 50.1% 36.2% 102.0% 84.0% 58.3%<br />

Income keeps up with 2.5% inflation and the withdrawal rate is 5%.<br />

Growth in real incomes necessitates a greater savings rate to<br />

maintain the income replacement ratios. A 1% real increase in salary over 35<br />

years means that the pre-retirement real income would be 40% higher than the<br />

initial real income. The greater the real salary growth rate and the higher the<br />

standard of living prior to retirement, the larger the savings rate necessary to<br />

©2008, IARFC All rights of reproduction in any form reserved.