3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

124<br />

Journal of Personal Finance<br />

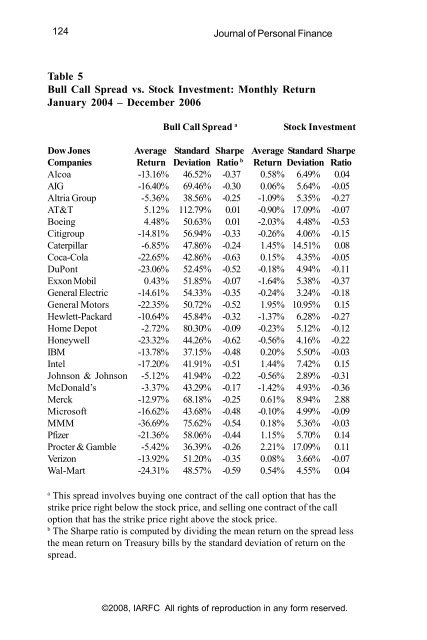

Table 5<br />

Bull Call Spread vs. Stock Investment: Monthly Return<br />

January 2004 – December 2006<br />

Bull Call Spread a Stock Investment<br />

Dow Jones Average Standard Sharpe Average Standard Sharpe<br />

Companies Return Deviation Ratio b Return Deviation Ratio<br />

Alcoa -13.16% 46.52% -0.37 0.58% 6.49% 0.04<br />

AIG -16.40% 69.46% -0.30 0.06% 5.64% -0.05<br />

Altria Group -5.36% 38.56% -0.25 -1.09% 5.35% -0.27<br />

AT&T 5.12% 112.79% 0.01 -0.90% 17.09% -0.07<br />

Boeing 4.48% 50.63% 0.01 -2.03% 4.48% -0.53<br />

Citigroup -14.81% 56.94% -0.33 -0.26% 4.06% -0.15<br />

Caterpillar -6.85% 47.86% -0.24 1.45% 14.51% 0.08<br />

Coca-Cola -22.65% 42.86% -0.63 0.15% 4.35% -0.05<br />

DuPont -23.06% 52.45% -0.52 -0.18% 4.94% -0.11<br />

Exxon Mobil 0.43% 51.85% -0.07 -1.64% 5.38% -0.37<br />

General Electric -14.61% 54.33% -0.35 -0.24% 3.24% -0.18<br />

General Motors -22.35% 50.72% -0.52 1.95% 10.95% 0.15<br />

Hewlett-Packard -10.64% 45.84% -0.32 -1.37% 6.28% -0.27<br />

Home Depot -2.72% 80.30% -0.09 -0.23% 5.12% -0.12<br />

Honeywell -23.32% 44.26% -0.62 -0.56% 4.16% -0.22<br />

IBM -13.78% 37.15% -0.48 0.20% 5.50% -0.03<br />

Intel -17.20% 41.91% -0.51 1.44% 7.42% 0.15<br />

Johnson & Johnson -5.12% 41.94% -0.22 -0.56% 2.89% -0.31<br />

McDonald’s -3.37% 43.29% -0.17 -1.42% 4.93% -0.36<br />

Merck -12.97% 68.18% -0.25 0.61% 8.94% 2.88<br />

Microsoft -16.62% 43.68% -0.48 -0.10% 4.99% -0.09<br />

MMM -36.69% 75.62% -0.54 0.18% 5.36% -0.03<br />

Pfizer -21.36% 58.06% -0.44 1.15% 5.70% 0.14<br />

Procter & Gamble -5.42% 36.39% -0.26 2.21% 17.09% 0.11<br />

Verizon -13.92% 51.20% -0.35 0.08% 3.66% -0.07<br />

Wal-Mart -24.31% 48.57% -0.59 0.54% 4.55% 0.04<br />

a<br />

This spread in<strong>vol</strong>ves buying one contract of the call option that has the<br />

strike price right below the stock price, and selling one contract of the call<br />

option that has the strike price right above the stock price.<br />

b<br />

The Sharpe ratio is computed by dividing the mean return on the spread less<br />

the mean return on Treasury bills by the standard deviation of return on the<br />

spread.<br />

©2008, IARFC All rights of reproduction in any form reserved.