3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

3433-vol. 6 issue 2-3.pmd - iarfc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90<br />

Journal of Personal Finance<br />

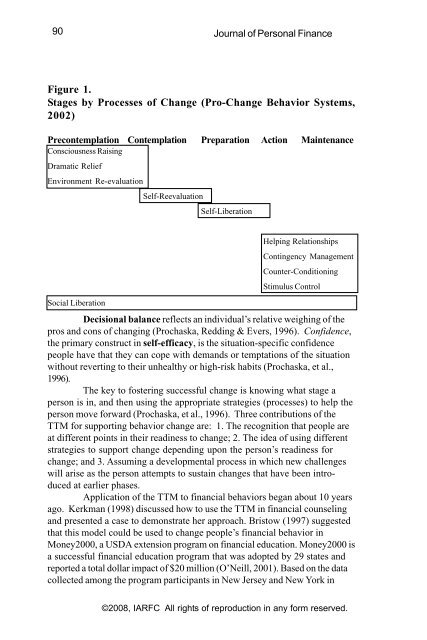

Figure 1.<br />

Stages by Processes of Change (Pro-Change Behavior Systems,<br />

2002)<br />

Precontemplation Contemplation Preparation Action Maintenance<br />

Consciousness Raising<br />

Dramatic Relief<br />

Environment Re-evaluation<br />

Self-Reevaluation<br />

Self-Liberation<br />

Social Liberation<br />

Helping Relationships<br />

Contingency Management<br />

Counter-Conditioning<br />

Stimulus Control<br />

Decisional balance reflects an individual’s relative weighing of the<br />

pros and cons of changing (Prochaska, Redding & Evers, 1996). Confidence,<br />

the primary construct in self-efficacy, is the situation-specific confidence<br />

people have that they can cope with demands or temptations of the situation<br />

without reverting to their unhealthy or high-risk habits (Prochaska, et al.,<br />

1996).<br />

The key to fostering successful change is knowing what stage a<br />

person is in, and then using the appropriate strategies (processes) to help the<br />

person move forward (Prochaska, et al., 1996). Three contributions of the<br />

TTM for supporting behavior change are: 1. The recognition that people are<br />

at different points in their readiness to change; 2. The idea of using different<br />

strategies to support change depending upon the person’s readiness for<br />

change; and 3. Assuming a developmental process in which new challenges<br />

will arise as the person attempts to sustain changes that have been introduced<br />

at earlier phases.<br />

Application of the TTM to financial behaviors began about 10 years<br />

ago. Kerkman (1998) discussed how to use the TTM in financial counseling<br />

and presented a case to demonstrate her approach. Bristow (1997) suggested<br />

that this model could be used to change people’s financial behavior in<br />

Money2000, a USDA extension program on financial education. Money2000 is<br />

a successful financial education program that was adopted by 29 states and<br />

reported a total dollar impact of $20 million (O’Neill, 2001). Based on the data<br />

collected among the program participants in New Jersey and New York in<br />

©2008, IARFC All rights of reproduction in any form reserved.