The Challenges of Growing Small Businesses - International Labour ...

The Challenges of Growing Small Businesses - International Labour ...

The Challenges of Growing Small Businesses - International Labour ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

cent <strong>of</strong> women able to name credit and finance agencies. One third <strong>of</strong> the women were<br />

aware <strong>of</strong> training providers, and 25 per cent were aware <strong>of</strong> those supplying business<br />

information services. This pr<strong>of</strong>ile mirrors to some extent the women entrepreneurs’ actual<br />

use <strong>of</strong> business support. <strong>The</strong> majority (70 per cent) <strong>of</strong> the women entrepreneurs had<br />

received no external support in starting their businesses. Of those receiving support (34<br />

women), most (21 or 62 per cent) had received financial support from MFIs, and some (11<br />

or 32 per cent) received technical support from a range <strong>of</strong> NGOs and government agencies.<br />

Whilst the MFIs were seen to have provided satisfactory services for start-up, those<br />

women running small enterprises felt that the MFI loans were too small and delivered<br />

inappropriately (in groups) for women wanting to grow their business. <strong>The</strong> same theme<br />

applied to training providers who were seen to focus on general start-up courses for<br />

microenterprises, rather than more specialized topics designed for growing small<br />

enterprises. One exception was a recent ILO initiative providing assistance to women<br />

entrepreneurs to be more effective at trade exhibitions, which was mentioned and viewed<br />

as having been very helpful (see Barney-Gonzales, 2002).<br />

In Zambia, less than one third <strong>of</strong> the women entrepreneurs had received support from<br />

some form <strong>of</strong> external business support service, and yet 90 per cent said that they felt in<br />

need <strong>of</strong> further support for their business. <strong>The</strong> majority <strong>of</strong> those who had not received<br />

support did not know where to go for help. Some had tried to get help and been<br />

unsuccessful, and others were put <strong>of</strong>f seeking assistance after hearing <strong>of</strong> the negative<br />

experiences <strong>of</strong> others – especially with regard to the lending conditions <strong>of</strong> the financial<br />

institutions. Those who had received support did so as follows: 25 per cent had received<br />

small business training support from a BDS provider; 21 per cent had received financial<br />

support from an MFI; 5 per cent had received business advice and counselling from an<br />

NGO, and 1 woman had been supported to attend a trade fair.<br />

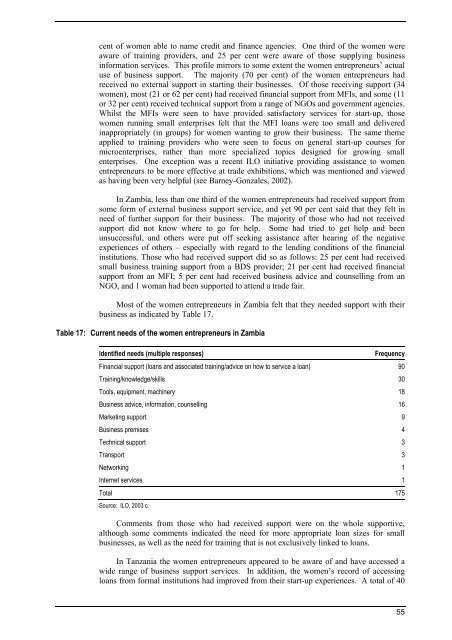

Most <strong>of</strong> the women entrepreneurs in Zambia felt that they needed support with their<br />

business as indicated by Table 17.<br />

Table 17: Current needs <strong>of</strong> the women entrepreneurs in Zambia<br />

Identified needs (multiple responses)<br />

Frequency<br />

Financial support (loans and associated training/advice on how to service a loan) 90<br />

Training/knowledge/skills 30<br />

Tools, equipment, machinery 18<br />

Business advice, information, counselling 16<br />

Marketing support 9<br />

Business premises 4<br />

Technical support 3<br />

Transport 3<br />

Networking 1<br />

Internet services 1<br />

Total 175<br />

Source: ILO, 2003 c.<br />

Comments from those who had received support were on the whole supportive,<br />

although some comments indicated the need for more appropriate loan sizes for small<br />

businesses, as well as the need for training that is not exclusively linked to loans.<br />

In Tanzania the women entrepreneurs appeared to be aware <strong>of</strong> and have accessed a<br />

wide range <strong>of</strong> business support services. In addition, the women’s record <strong>of</strong> accessing<br />

loans from formal institutions had improved from their start-up experiences. A total <strong>of</strong> 40<br />

55