4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2009 2008<br />

Rm<br />

Rm<br />

Financial Statements<br />

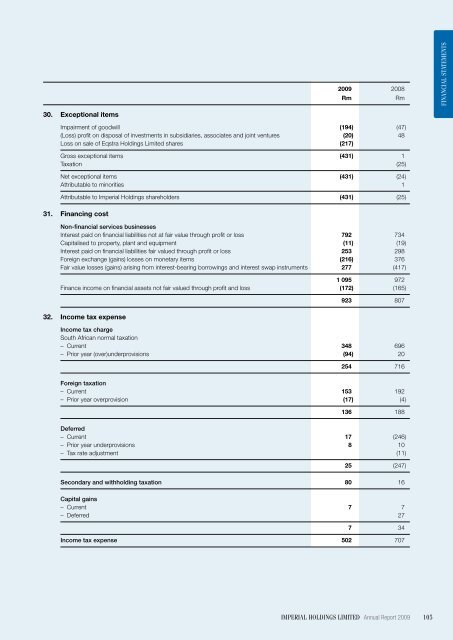

30. Exceptional items<br />

Impairment of goodwill (194) (47)<br />

(Loss) profit on disposal of investments in subsidiaries, associates and joint ventures (20) 48<br />

Loss on sale of Eqstra Holdings Limited shares (217)<br />

Gross exceptional items (431) 1<br />

Taxation (25)<br />

Net exceptional items (431) (24)<br />

Attributable to minorities 1<br />

Attributable to <strong>Imperial</strong> Holdings shareholders (431) (25)<br />

31. Financing cost<br />

Non-financial services businesses<br />

Interest paid on financial liabilities not at fair value through profit or loss 792 734<br />

Capitalised to property, plant and equipment (11) (19)<br />

Interest paid on financial liabilities fair valued through profit or loss 253 298<br />

Foreign exchange (gains) losses on monetary items (216) 376<br />

Fair value losses (gains) arising from interest-bearing borrowings and interest swap instruments 277 (417)<br />

1 095 972<br />

Finance income on financial assets not fair valued through profit and loss (172) (165)<br />

923 807<br />

32. Income tax expense<br />

Income tax charge<br />

South African normal taxation<br />

– Current 348 696<br />

– Prior year (over)underprovisions (94) 20<br />

254 716<br />

Foreign taxation<br />

– Current 153 192<br />

– Prior year overprovision (17) (4)<br />

136 188<br />

Deferred<br />

– Current 17 (246)<br />

– Prior year underprovisions 8 10<br />

– Tax rate adjustment (11)<br />

25 (247)<br />

Secondary and withholding taxation 80 16<br />

Capital gains<br />

– Current 7 7<br />

– Deferred 27<br />

7 34<br />

Income tax expense 502 707<br />

<strong>Imperial</strong> holdings limited Annual Report 2009 105