4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

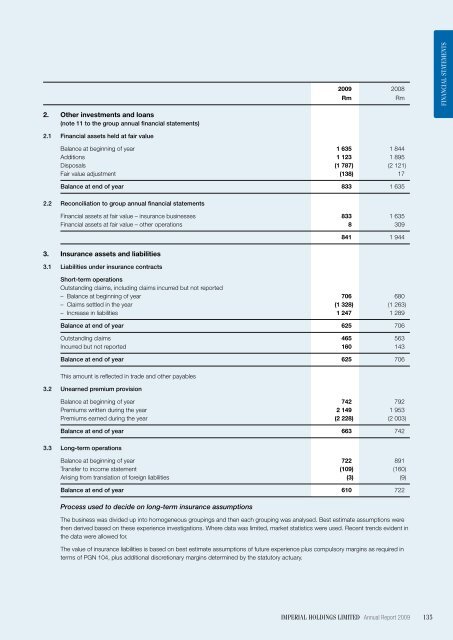

2009 2008<br />

Rm<br />

Rm<br />

Financial Statements<br />

2. Other investments and loans<br />

(note 11 to the group annual financial statements)<br />

2.1 Financial assets held at fair value<br />

Balance at beginning of year 1 635 1 844<br />

Additions 1 123 1 895<br />

Disposals (1 787) (2 121)<br />

Fair value adjustment (138) 17<br />

Balance at end of year 833 1 635<br />

2.2 Reconciliation to group annual financial statements<br />

Financial assets at fair value – insurance businesses 833 1 635<br />

Financial assets at fair value – other operations 8 309<br />

841 1 944<br />

3. Insurance assets and liabilities<br />

3.1 Liabilities under insurance contracts<br />

Short-term operations<br />

Outstanding claims, including claims incurred but not reported<br />

– Balance at beginning of year 706 680<br />

– Claims settled in the year (1 328) (1 263)<br />

– Increase in liabilities 1 247 1 289<br />

Balance at end of year 625 706<br />

Outstanding claims 465 563<br />

Incurred but not reported 160 143<br />

Balance at end of year 625 706<br />

This amount is reflected in trade and other payables<br />

3.2 Unearned premium provision<br />

Balance at beginning of year 742 792<br />

Premiums written during the year 2 149 1 953<br />

Premiums earned during the year (2 228) (2 003)<br />

Balance at end of year 663 742<br />

3.3 Long-term operations<br />

Balance at beginning of year 722 891<br />

Transfer to income statement (109) (160)<br />

Arising from translation of foreign liabilities (3) (9)<br />

Balance at end of year 610 722<br />

Process used to decide on long-term insurance assumptions<br />

The business was divided up into homogeneous groupings and then each grouping was analysed. Best estimate assumptions were<br />

then derived based on these experience investigations. Where data was limited, market statistics were used. Recent trends evident in<br />

the data were allowed for.<br />

The value of insurance liabilities is based on best estimate assumptions of future experience plus compulsory margins as required in<br />

terms of PGN 104, plus additional discretionary margins determined by the statutory actuary.<br />

<strong>Imperial</strong> holdings limited Annual Report 2009 135