4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

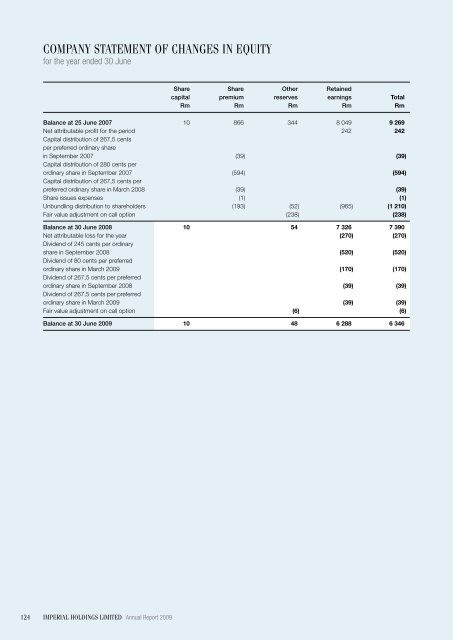

company statement of changes IN equIty<br />

for the year ended 30 June<br />

Share Share Other Retained<br />

capital premium reserves earnings Total<br />

Rm Rm Rm Rm Rm<br />

Balance at 25 June 2007 10 866 344 8 049 9 269<br />

Net attributable profit for the period 242 242<br />

Capital distribution of 267,5 cents<br />

per preferred ordinary share<br />

in September 2007 (39) (39)<br />

Capital distribution of 280 cents per<br />

ordinary share in September 2007 (594) (594)<br />

Capital distribution of 267,5 cents per<br />

preferred ordinary share in March 2008 (39) (39)<br />

Share issues expenses (1) (1)<br />

Unbundling distribution to shareholders (193) (52) (965) (1 210)<br />

Fair value adjustment on call option (238) (238)<br />

Balance at 30 June 2008 10 54 7 326 7 390<br />

Net attributable loss for the year (270) (270)<br />

Dividend of 245 cents per ordinary<br />

share in September 2008 (520) (520)<br />

Dividend of 80 cents per preferred<br />

ordinary share in March 2009 (170) (170)<br />

Dividend of 267,5 cents per preferred<br />

ordinary share in September 2008 (39) (39)<br />

Dividend of 267,5 cents per preferred<br />

ordinary share in March 2009 (39) (39)<br />

Fair value adjustment on call option (6) (6)<br />

Balance at 30 June 2009 10 48 6 288 6 346<br />

124<br />

<strong>Imperial</strong> holdings limited Annual Report 2009