4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

39. Financial instruments (continued)<br />

Credit risk (continued)<br />

Financial Statements<br />

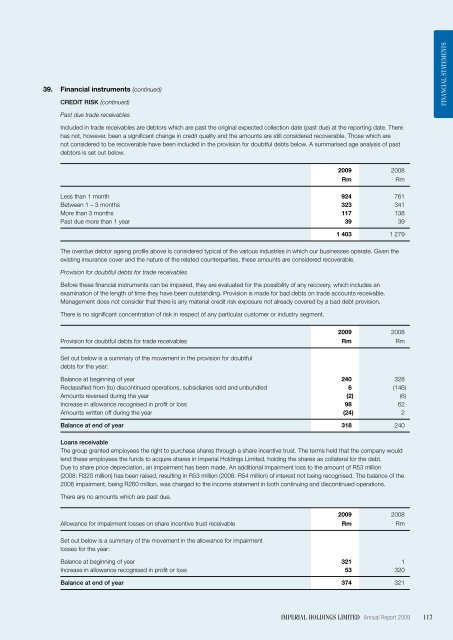

Past due trade receivables<br />

Included in trade receivables are debtors which are past the original expected collection date (past due) at the reporting date. There<br />

has not, however, been a significant change in credit quality and the amounts are still considered recoverable. Those which are<br />

not considered to be recoverable have been included in the provision for doubtful debts below. A summarised age analysis of past<br />

debtors is set out below.<br />

2009 2008<br />

Rm<br />

Rm<br />

Less than 1 month 924 761<br />

Between 1 – 3 months 323 341<br />

More than 3 months 117 138<br />

Past due more than 1 year 39 39<br />

1 403 1 279<br />

The overdue debtor ageing profile above is considered typical of the various industries in which our businesses operate. Given the<br />

existing insurance cover and the nature of the related counterparties, these amounts are considered recoverable.<br />

Provision for doubtful debts for trade receivables<br />

Before these financial instruments can be impaired, they are evaluated for the possibility of any recovery, which includes an<br />

examination of the length of time they have been outstanding. Provision is made for bad debts on trade accounts receivable.<br />

Management does not consider that there is any material credit risk exposure not already covered by a bad debt provision.<br />

There is no significant concentration of risk in respect of any particular customer or industry segment.<br />

2009 2008<br />

Provision for doubtful debts for trade receivables Rm Rm<br />

Set out below is a summary of the movement in the provision for doubtful<br />

debts for the year:<br />

Balance at beginning of year 240 328<br />

Reclassified from (to) discontinued operations, subsidiaries sold and unbundled 6 (146)<br />

Amounts reversed during the year (2) (6)<br />

Increase in allowance recognised in profit or loss 98 62<br />

Amounts written off during the year (24) 2<br />

Balance at end of year 318 240<br />

Loans receivable<br />

The group granted employees the right to purchase shares through a share incentive trust. The terms held that the company would<br />

lend these employees the funds to acquire shares in <strong>Imperial</strong> Holdings Limited, holding the shares as collateral for the debt.<br />

Due to share price depreciation, an impairment has been made. An additional impairment loss to the amount of R53 million<br />

(2008: R320 million) has been raised, resulting in R53 million (2008: R54 million) of interest not being recognised. The balance of the<br />

2008 impairment, being R260 million, was charged to the income statement in both continuing and discontinued operations.<br />

There are no amounts which are past due.<br />

2009 2008<br />

Allowance for impairment losses on share incentive trust receivable Rm Rm<br />

Set out below is a summary of the movement in the allowance for impairment<br />

losses for the year:<br />

Balance at beginning of year 321 1<br />

Increase in allowance recognised in profit or loss 53 320<br />

Balance at end of year 374 321<br />

<strong>Imperial</strong> holdings limited Annual Report 2009 117