4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

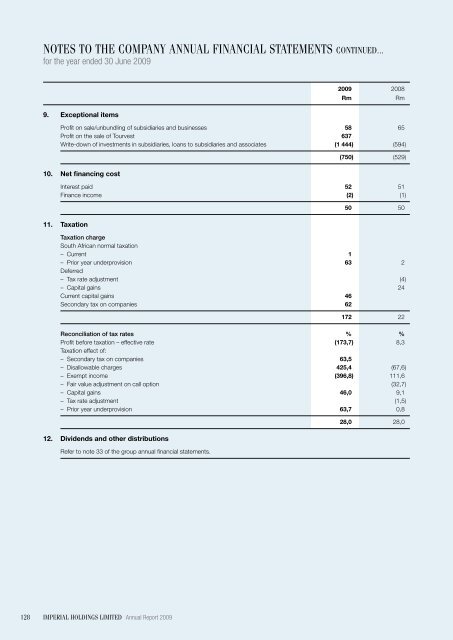

Notes to the company annual financial statements continued...<br />

for the year ended 30 June 2009<br />

9. Exceptional items<br />

2009 2008<br />

Profit on sale/unbundling of subsidiaries and businesses 58 65<br />

Profit on the sale of Tourvest 637<br />

Write-down of investments in subsidiaries, loans to subsidiaries and associates (1 444) (594)<br />

Rm<br />

Rm<br />

(750) (529)<br />

10. Net financing cost<br />

Interest paid 52 51<br />

Finance income (2) (1)<br />

50 50<br />

11. Taxation<br />

Taxation charge<br />

South African normal taxation<br />

– Current 1<br />

– Prior year underprovision 63 2<br />

Deferred<br />

– Tax rate adjustment (4)<br />

– Capital gains 24<br />

Current capital gains 46<br />

Secondary tax on companies 62<br />

172 22<br />

Reconciliation of tax rates % %<br />

Profit before taxation – effective rate (173,7) 8,3<br />

Taxation effect of:<br />

– Secondary tax on companies 63,5<br />

– Disallowable charges 425,4 (67,6)<br />

– Exempt income (396,8) 111,6<br />

– Fair value adjustment on call option (32,7)<br />

– Capital gains 46,0 9,1<br />

– Tax rate adjustment (1,5)<br />

– Prior year underprovision 63,7 0,8<br />

28,0 28,0<br />

12. Dividends and other distributions<br />

Refer to note 33 of the group annual financial statements.<br />

128<br />

<strong>Imperial</strong> holdings limited Annual Report 2009