4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

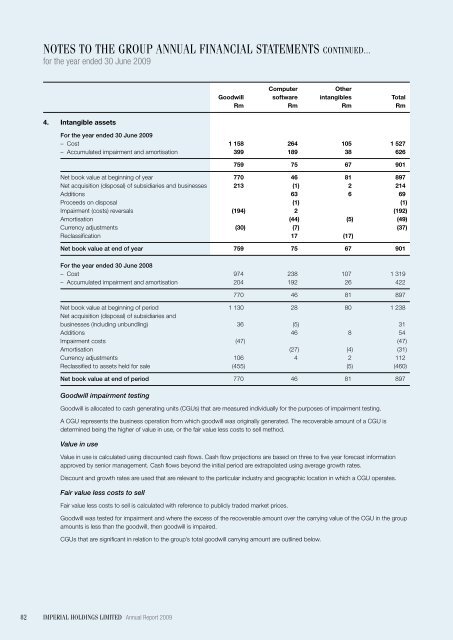

Notes to the group annual financial statements continued...<br />

for the year ended 30 June 2009<br />

4. Intangible assets<br />

Computer<br />

Other<br />

Goodwill software intangibles Total<br />

Rm Rm Rm Rm<br />

For the year ended 30 June 2009<br />

– Cost 1 158 264 105 1 527<br />

– Accumulated impairment and amortisation 399 189 38 626<br />

759 75 67 901<br />

Net book value at beginning of year 770 46 81 897<br />

Net acquisition (disposal) of subsidiaries and businesses 213 (1) 2 214<br />

Additions 63 6 69<br />

Proceeds on disposal (1) (1)<br />

Impairment (costs) reversals (194) 2 (192)<br />

Amortisation (44) (5) (49)<br />

Currency adjustments (30) (7) (37)<br />

Reclassification 17 (17)<br />

Net book value at end of year 759 75 67 901<br />

For the year ended 30 June 2008<br />

– Cost 974 238 107 1 319<br />

– Accumulated impairment and amortisation 204 192 26 422<br />

770 46 81 897<br />

Net book value at beginning of period 1 130 28 80 1 238<br />

Net acquisition (disposal) of subsidiaries and<br />

businesses (including unbundling) 36 (5) 31<br />

Additions 46 8 54<br />

Impairment costs (47) (47)<br />

Amortisation (27) (4) (31)<br />

Currency adjustments 106 4 2 112<br />

Reclassified to assets held for sale (455) (5) (460)<br />

Net book value at end of period 770 46 81 897<br />

Goodwill impairment testing<br />

Goodwill is allocated to cash generating units (CGUs) that are measured individually for the purposes of impairment testing.<br />

A CGU represents the business operation from which goodwill was originally generated. The recoverable amount of a CGU is<br />

determined being the higher of value in use, or the fair value less costs to sell method.<br />

Value in use<br />

Value in use is calculated using discounted cash flows. Cash flow projections are based on three to five year forecast information<br />

approved by senior management. Cash flows beyond the initial period are extrapolated using average growth rates.<br />

Discount and growth rates are used that are relevant to the particular industry and geographic location in which a CGU operates.<br />

Fair value less costs to sell<br />

Fair value less costs to sell is calculated with reference to publicly traded market prices.<br />

Goodwill was tested for impairment and where the excess of the recoverable amount over the carrying value of the CGU in the group<br />

amounts is less than the goodwill, then goodwill is impaired.<br />

CGUs that are significant in relation to the group’s total goodwill carrying amount are outlined below.<br />

82<br />

<strong>Imperial</strong> holdings limited Annual Report 2009