4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNEXURE C<br />

additional information on insurance businesses continued...<br />

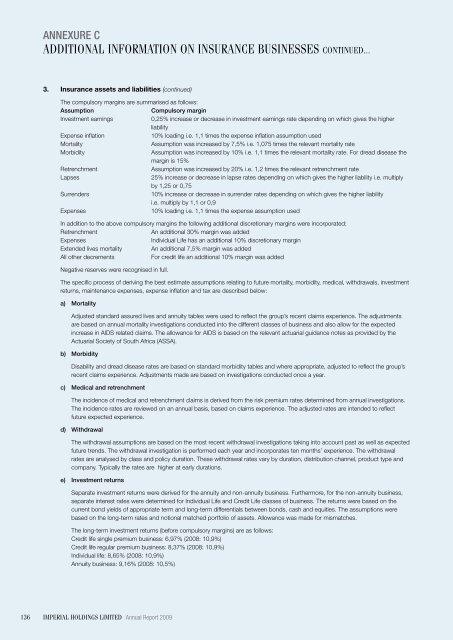

3. Insurance assets and liabilities (continued)<br />

The compulsory margins are summarised as follows:<br />

Assumption<br />

Compulsory margin<br />

Investment earnings<br />

0,25% increase or decrease in investment earnings rate depending on which gives the higher<br />

liability<br />

Expense inflation<br />

10% loading i.e. 1,1 times the expense inflation assumption used<br />

Mortality<br />

Assumption was increased by 7,5% i.e. 1,075 times the relevant mortality rate<br />

Morbidity<br />

Assumption was increased by 10% i.e. 1,1 times the relevant mortality rate. For dread disease the<br />

margin is 15%<br />

Retrenchment<br />

Assumption was increased by 20% i.e. 1,2 times the relevant retrenchment rate<br />

Lapses 25% increase or decrease in lapse rates depending on which gives the higher liability i.e. multiply<br />

by 1,25 or 0,75<br />

Surrenders<br />

10% increase or decrease in surrender rates depending on which gives the higher liability<br />

i.e. multiply by 1,1 or 0,9<br />

Expenses<br />

10% loading i.e. 1,1 times the expense assumption used<br />

In addition to the above compulsory margins the following additional discretionary margins were incorporated:<br />

Retrenchment<br />

An additional 30% margin was added<br />

Expenses<br />

Individual Life has an additional 10% discretionary margin<br />

Extended lives mortality An additional 7,5% margin was added<br />

All other decrements<br />

For credit life an additional 10% margin was added<br />

Negative reserves were recognised in full.<br />

The specific process of deriving the best estimate assumptions relating to future mortality, morbidity, medical, withdrawals, investment<br />

returns, maintenance expenses, expense inflation and tax are described below:<br />

a) Mortality<br />

Adjusted standard assured lives and annuity tables were used to reflect the group’s recent claims experience. The adjustments<br />

are based on annual mortality investigations conducted into the different classes of business and also allow for the expected<br />

increase in AIDS related claims. The allowance for AIDS is based on the relevant actuarial guidance notes as provided by the<br />

Actuarial Society of South Africa (ASSA).<br />

b) Morbidity<br />

Disability and dread disease rates are based on standard morbidity tables and where appropriate, adjusted to reflect the group’s<br />

recent claims experience. Adjustments made are based on investigations conducted once a year.<br />

c) Medical and retrenchment<br />

The incidence of medical and retrenchment claims is derived from the risk premium rates determined from annual investigations.<br />

The incidence rates are reviewed on an annual basis, based on claims experience. The adjusted rates are intended to reflect<br />

future expected experience.<br />

d) Withdrawal<br />

The withdrawal assumptions are based on the most recent withdrawal investigations taking into account past as well as expected<br />

future trends. The withdrawal investigation is performed each year and incorporates ten months’ experience. The withdrawal<br />

rates are analysed by class and policy duration. These withdrawal rates vary by duration, distribution channel, product type and<br />

company. Typically the rates are higher at early durations.<br />

e) Investment returns<br />

Separate investment returns were derived for the annuity and non-annuity business. Furthermore, for the non-annuity business,<br />

separate interest rates were determined for Individual Life and Credit Life classes of business. The returns were based on the<br />

current bond yields of appropriate term and long-term differentials between bonds, cash and equities. The assumptions were<br />

based on the long-term rates and notional matched portfolio of assets. Allowance was made for mismatches.<br />

The long-term investment returns (before compulsory margins) are as follows:<br />

Credit life single premium business: 6,97% (2008: 10,9%)<br />

Credit life regular premium business: 8,37% (2008: 10,9%)<br />

Individual life: 8,65% (2008: 10,9%)<br />

Annuity business: 9,16% (2008: 10,5%)<br />

136<br />

<strong>Imperial</strong> holdings limited Annual Report 2009