4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the group annual financial statements continued...<br />

for the year ended 30 June 2009<br />

39. Financial instruments (continued)<br />

Fair value of financial instruments by category (continued)<br />

The directors consider that the carrying amounts of cash and cash equivalents, trade and other receivables and trade and other<br />

payables approximates their fair value due to the short-term maturities of these assets and liabilities.<br />

The fair values of financial assets represent the market value of quoted investments and other traded instruments. For non-listed<br />

investments and other non-traded financial assets fair value is calculated using discounted cash flows with market assumptions,<br />

unless the carrying value is considered to approximate fair value.<br />

The fair values of financial liabilities is determined by reference to quoted market prices for similar issues, where applicable, otherwise<br />

the carrying value approximates the fair value.<br />

There were no defaults or breaches in terms of interest-bearing borrowings during either reporting periods.<br />

There were no reclassifications of financial assets or financial liabilities that occurred during the period. There were no financial assets<br />

or liabilities that did not qualify for derecognition during the period.<br />

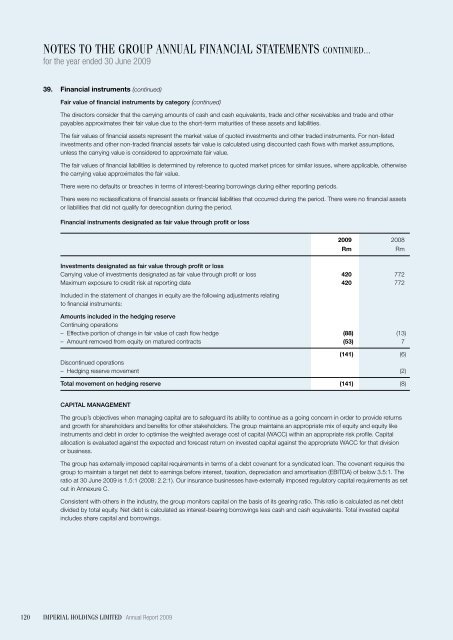

Financial instruments designated as fair value through profit or loss<br />

2009 2008<br />

Rm<br />

Rm<br />

Investments designated as fair value through profit or loss<br />

Carrying value of investments designated as fair value through profit or loss 420 772<br />

Maximum exposure to credit risk at reporting date 420 772<br />

Included in the statement of changes in equity are the following adjustments relating<br />

to financial instruments:<br />

Amounts included in the hedging reserve<br />

Continuing operations<br />

– Effective portion of change in fair value of cash flow hedge (88) (13)<br />

– Amount removed from equity on matured contracts (53) 7<br />

(141) (6)<br />

Discontinued operations<br />

– Hedging reserve movement (2)<br />

Total movement on hedging reserve (141) (8)<br />

Capital management<br />

The group’s objectives when managing capital are to safeguard its ability to continue as a going concern in order to provide returns<br />

and growth for shareholders and benefits for other stakeholders. The group maintains an appropriate mix of equity and equity like<br />

instruments and debt in order to optimise the weighted average cost of capital (WACC) within an appropriate risk profile. Capital<br />

allocation is evaluated against the expected and forecast return on invested capital against the appropriate WACC for that division<br />

or business.<br />

The group has externally imposed capital requirements in terms of a debt covenant for a syndicated loan. The covenant requires the<br />

group to maintain a target net debt to earnings before interest, taxation, depreciation and amortisation (EBITDA) of below 3.5:1. The<br />

ratio at 30 June 2009 is 1.5:1 (2008: 2.2:1). Our insurance businesses have externally imposed regulatory capital requirements as set<br />

out in Annexure C.<br />

Consistent with others in the industry, the group monitors capital on the basis of its gearing ratio. This ratio is calculated as net debt<br />

divided by total equity. Net debt is calculated as interest-bearing borrowings less cash and cash equivalents. Total invested capital<br />

includes share capital and borrowings.<br />

120<br />

<strong>Imperial</strong> holdings limited Annual Report 2009