4.0 - Imperial

4.0 - Imperial

4.0 - Imperial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2009 2008<br />

Rm<br />

Rm<br />

Financial Statements<br />

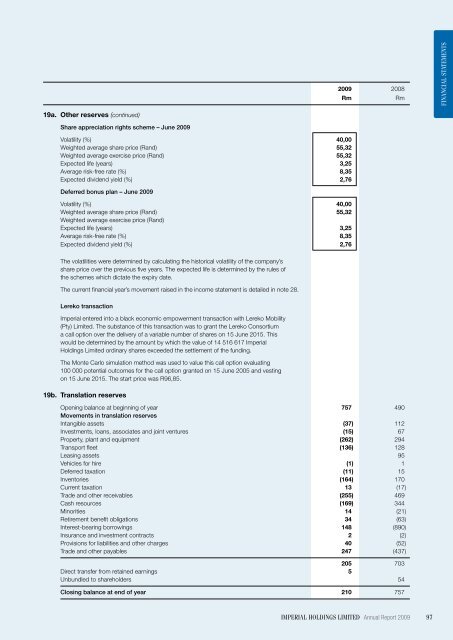

19a. Other reserves (continued)<br />

Share appreciation rights scheme – June 2009<br />

Volatility (%) 40,00<br />

Weighted average share price (Rand) 55,32<br />

Weighted average exercise price (Rand) 55,32<br />

Expected life (years) 3,25<br />

Average risk-free rate (%) 8,35<br />

Expected dividend yield (%) 2,76<br />

Deferred bonus plan – June 2009<br />

Volatility (%) 40,00<br />

Weighted average share price (Rand) 55,32<br />

Weighted average exercise price (Rand)<br />

Expected life (years) 3,25<br />

Average risk-free rate (%) 8,35<br />

Expected dividend yield (%) 2,76<br />

The volatilities were determined by calculating the historical volatility of the company’s<br />

share price over the previous five years. The expected life is determined by the rules of<br />

the schemes which dictate the expiry date.<br />

The current financial year’s movement raised in the income statement is detailed in note 28.<br />

Lereko transaction<br />

<strong>Imperial</strong> entered into a black economic empowerment transaction with Lereko Mobility<br />

(Pty) Limited. The substance of this transaction was to grant the Lereko Consortium<br />

a call option over the delivery of a variable number of shares on 15 June 2015. This<br />

would be determined by the amount by which the value of 14 516 617 <strong>Imperial</strong><br />

Holdings Limited ordinary shares exceeded the settlement of the funding.<br />

The Monte Carlo simulation method was used to value this call option evaluating<br />

100 000 potential outcomes for the call option granted on 15 June 2005 and vesting<br />

on 15 June 2015. The start price was R96,85.<br />

19b. Translation reserves<br />

Opening balance at beginning of year 757 490<br />

Movements in translation reserves<br />

Intangible assets (37) 112<br />

Investments, loans, associates and joint ventures (15) 67<br />

Property, plant and equipment (262) 294<br />

Transport fleet (136) 128<br />

Leasing assets 95<br />

Vehicles for hire (1) 1<br />

Deferred taxation (11) 15<br />

Inventories (164) 170<br />

Current taxation 13 (17)<br />

Trade and other receivables (255) 469<br />

Cash resources (169) 344<br />

Minorities 14 (21)<br />

Retirement benefit obligations 34 (63)<br />

Interest-bearing borrowings 148 (890)<br />

Insurance and investment contracts 2 (2)<br />

Provisions for liabilities and other charges 40 (52)<br />

Trade and other payables 247 (437)<br />

205 703<br />

Direct transfer from retained earnings 5<br />

Unbundled to shareholders 54<br />

Closing balance at end of year 210 757<br />

<strong>Imperial</strong> holdings limited Annual Report 2009 97