2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Half</strong>-year report at 30 June <strong>2009</strong><br />

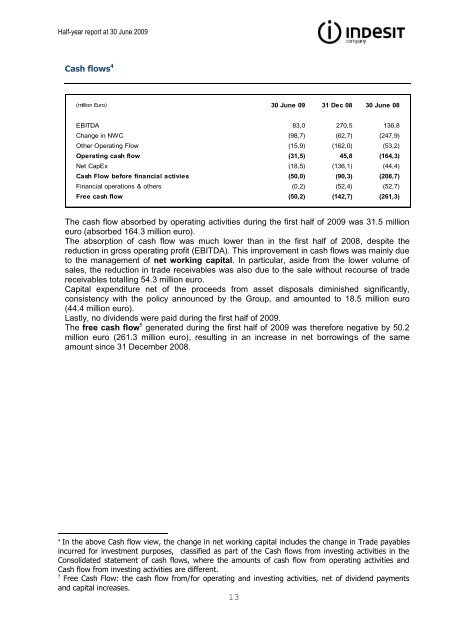

Cash flows 4<br />

(million Euro) 30 June 09 31 Dec 08 30 June 08<br />

EBITDA 83,0 270,5 136,8<br />

Change in NWC (98,7) (62,7) (247,9)<br />

Other Operating Flow (15,9) (162,0) (53,2)<br />

Operating cash flow (31,5) 45,8 (164,3)<br />

Net CapEx (18,5) (136,1) (44,4)<br />

Cash Flow before financial activies (50,0) (90,3) (208,7)<br />

Financial operations & others (0,2) (52,4) (52,7)<br />

Free cash flow (50,2) (142,7) (261,3)<br />

The cash flow absorbed by operating activities during the first half of <strong>2009</strong> was 31.5 million<br />

euro (absorbed 164.3 million euro).<br />

The absorption of cash flow was much lower than in the first half of 2008, despite the<br />

reduction in gross operating profit (EBITDA). This improvement in cash flows was mainly due<br />

to the management of net working capital. In particular, aside from the lower volume of<br />

sales, the reduction in trade receivables was also due to the sale without recourse of trade<br />

receivables totalling 54.3 million euro.<br />

Capital expenditure net of the proceeds from asset disposals diminished significantly,<br />

consistency with the policy announced by the Group, and amounted to 18.5 million euro<br />

(44.4 million euro).<br />

Lastly, no dividends were paid during the first half of <strong>2009</strong>.<br />

The free cash flow 5 generated during the first half of <strong>2009</strong> was therefore negative by 50.2<br />

million euro (261.3 million euro), resulting in an increase in net borrowings of the same<br />

amount since 31 December 2008.<br />

4<br />

In the above Cash flow view, the change in net working capital includes the change in Trade payables<br />

incurred for investment purposes, classified as part of the Cash flows from investing activities in the<br />

Consolidated statement of cash flows, where the amounts of cash flow from operating activities and<br />

Cash flow from investing activities are different.<br />

5 Free Cash Flow: the cash flow from/for operating and investing activities, net of dividend payments<br />

and capital increases.<br />

13