2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Half</strong>-year report at 30 June <strong>2009</strong><br />

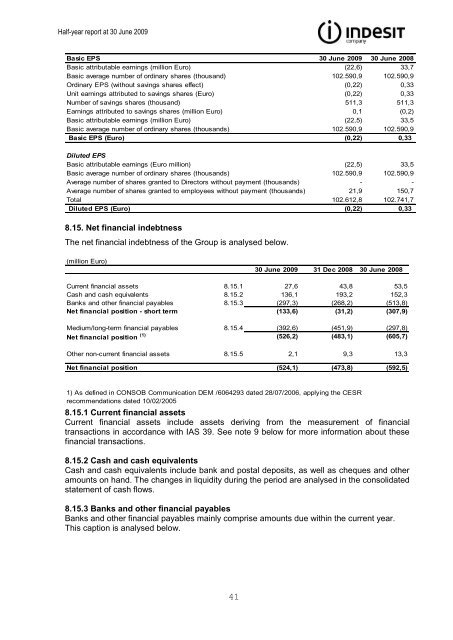

Basic EPS 30 June <strong>2009</strong> 30 June 2008<br />

Basic attributable earnings (million Euro) (22,6) 33,7<br />

Basic average number of ordinary shares (thousand) 102.590,9 102.590,9<br />

Ordinary EPS (without savings shares effect) (0,22) 0,33<br />

Unit earnings attributed to savings shares (Euro) (0,22) 0,33<br />

Number of savings shares (thousand) 511,3 511,3<br />

Earnings attributed to savings shares (million Euro) 0,1 (0,2)<br />

Basic attributable earnings (million Euro) (22,5) 33,5<br />

Basic average number of ordinary shares (thousands) 102.590,9 102.590,9<br />

Basic EPS (Euro) (0,22) 0,33<br />

Diluted EPS<br />

Basic attributable earnings (Euro million) (22,5) 33,5<br />

Basic average number of ordinary shares (thousands) 102.590,9 102.590,9<br />

Average number of shares granted to Directors without payment (thousands) - -<br />

Average number of shares granted to employees without payment (thousands) 21,9 150,7<br />

Total 102.612,8 102.741,7<br />

Diluted EPS (Euro) (0,22) 0,33<br />

8.15. Net financial indebtness<br />

The net financial indebtness of the Group is analysed below.<br />

(million Euro)<br />

30 June <strong>2009</strong> 31 Dec 2008 30 June 2008<br />

Current financial assets 8.15.1 27,6 43,8 53,5<br />

Cash and cash equivalents 8.15.2 136,1 193,2 152,3<br />

Banks and other financial payables 8.15.3 (297,3) (268,2) (513,8)<br />

Net financial position - short term (133,6) (31,2) (307,9)<br />

Medium/long-term financial payables 8.15.4 (392,6) (451,9) (297,8)<br />

Net financial position (1) (526,2) (483,1) (605,7)<br />

Other non-current financial assets 8.15.5 2,1 9,3 13,3<br />

Net financial position (524,1) (473,8) (592,5)<br />

1) As defined in CONSOB Communication DEM /6064293 dated 28/07/2006, applying the CESR<br />

recommendations dated 10/02/2005<br />

8.15.1 Current financial assets<br />

Current financial assets include assets deriving from the measurement of financial<br />

transactions in accordance with IAS 39. See note 9 below for more information about these<br />

financial transactions.<br />

8.15.2 Cash and cash equivalents<br />

Cash and cash equivalents include bank and postal deposits, as well as cheques and other<br />

amounts on hand. The changes in liquidity during the period are analysed in the consolidated<br />

statement of cash flows.<br />

8.15.3 Banks and other financial payables<br />

Banks and other financial payables mainly comprise amounts due within the current year.<br />

This caption is analysed below.<br />

41