2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

2009 1st Half Report - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

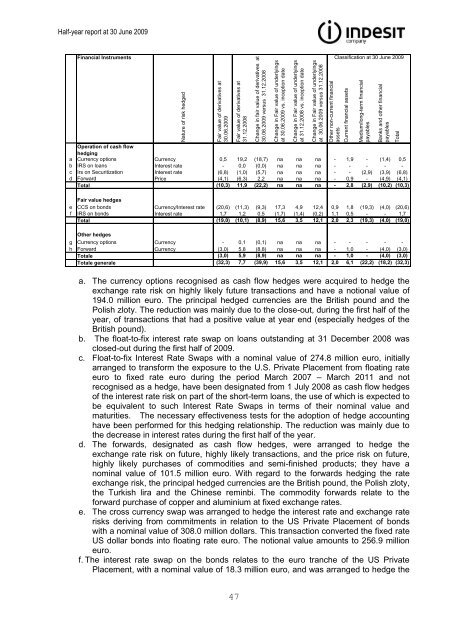

Nature of risk hedged<br />

Fair value of derivatives at<br />

30.06.<strong>2009</strong><br />

Fair value of derivatives at<br />

31.12.2008<br />

Change in fair value of derivatives at<br />

30.06.<strong>2009</strong> versus 31.12.2008<br />

Change in Fair value of underlyings<br />

at 30.06.<strong>2009</strong> vs. inception date<br />

Change in Fair value of underlyings<br />

at 31.12.2008 vs. inception date<br />

Change in Fair value of underlyings<br />

at 30.06.<strong>2009</strong> versus 31.12.2008<br />

Other non-current financial<br />

assets<br />

Current financial assets<br />

Medium/long-term financial<br />

payables<br />

Banks and other financial<br />

payables<br />

Total<br />

<strong>Half</strong>-year report at 30 June <strong>2009</strong><br />

Financial Instruments<br />

Classification at 30 June <strong>2009</strong><br />

Operation of cash flow<br />

hedging<br />

a Currency options Currency 0,5 19,2 (18,7) na na na - 1,9 - (1,4) 0,5<br />

b IRS on loans Interest rate - 0,0 (0,0) na na na - - - - -<br />

c Irs on Securitization Interest rate (6,8) (1,0) (5,7) na na na - - (2,9) (3,9) (6,8)<br />

d Forward Price (4,1) (6,3) 2,2 na na na - 0,9 - (4,9) (4,1)<br />

Total (10,3) 11,9 (22,2) na na na - 2,8 (2,9) (10,2) (10,3)<br />

Fair value hedges<br />

e CCS on bonds Currency/Interest rate (20,6) (11,3) (9,3) 17,3 4,9 12,4 0,9 1,8 (19,3) (4,0) (20,6)<br />

f IRS on bonds Interest rate 1,7 1,2 0,5 (1,7) (1,4) (0,2) 1,1 0,5 - - 1,7<br />

Total (19,0) (10,1) (8,9) 15,6 3,5 12,1 2,0 2,3 (19,3) (4,0) (19,0)<br />

Other hedges<br />

g Currency options Currency - 0,1 (0,1) na na na - - - - -<br />

h Forward Currency (3,0) 5,8 (8,8) na na na - 1,0 - (4,0) (3,0)<br />

Totale (3,0) 5,9 (8,9) na na na - 1,0 - (4,0) (3,0)<br />

Totale generale (32,3) 7,7 (39,9) 15,6 3,5 12,1 2,0 6,1 (22,2) (18,2) (32,3)<br />

a. The currency options recognised as cash flow hedges were acquired to hedge the<br />

exchange rate risk on highly likely future transactions and have a notional value of<br />

194.0 million euro. The principal hedged currencies are the British pound and the<br />

Polish zloty. The reduction was mainly due to the close-out, during the first half of the<br />

year, of transactions that had a positive value at year end (especially hedges of the<br />

British pound).<br />

b. The float-to-fix interest rate swap on loans outstanding at 31 December 2008 was<br />

closed-out during the first half of <strong>2009</strong>.<br />

c. Float-to-fix Interest Rate Swaps with a nominal value of 274.8 million euro, initially<br />

arranged to transform the exposure to the U.S. Private Placement from floating rate<br />

euro to fixed rate euro during the period March 2007 – March 2011 and not<br />

recognised as a hedge, have been designated from 1 July 2008 as cash flow hedges<br />

of the interest rate risk on part of the short-term loans, the use of which is expected to<br />

be equivalent to such Interest Rate Swaps in terms of their nominal value and<br />

maturities. The necessary effectiveness tests for the adoption of hedge accounting<br />

have been performed for this hedging relationship. The reduction was mainly due to<br />

the decrease in interest rates during the first half of the year.<br />

d. The forwards, designated as cash flow hedges, were arranged to hedge the<br />

exchange rate risk on future, highly likely transactions, and the price risk on future,<br />

highly likely purchases of commodities and semi-finished products; they have a<br />

nominal value of 101.5 million euro. With regard to the forwards hedging the rate<br />

exchange risk, the principal hedged currencies are the British pound, the Polish zloty,<br />

the Turkish lira and the Chinese reminbi. The commodity forwards relate to the<br />

forward purchase of copper and aluminium at fixed exchange rates.<br />

e. The cross currency swap was arranged to hedge the interest rate and exchange rate<br />

risks deriving from commitments in relation to the US Private Placement of bonds<br />

with a nominal value of 308.0 million dollars. This transaction converted the fixed rate<br />

US dollar bonds into floating rate euro. The notional value amounts to 256.9 million<br />

euro.<br />

f. The interest rate swap on the bonds relates to the euro tranche of the US Private<br />

Placement, with a nominal value of 18.3 million euro, and was arranged to hedge the<br />

47