Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Separate financial statements at 31 December <strong>2012</strong> – Notes<br />

Other movements include the net effect, 0.9 million euro, resulting from the inclusion in <strong>2012</strong> of a<br />

financial guarantee of <strong>Indesit</strong> Company S.p.A. for <strong>Indesit</strong> Company Polska Sp.zo.o., to that already<br />

recognised in 2011.<br />

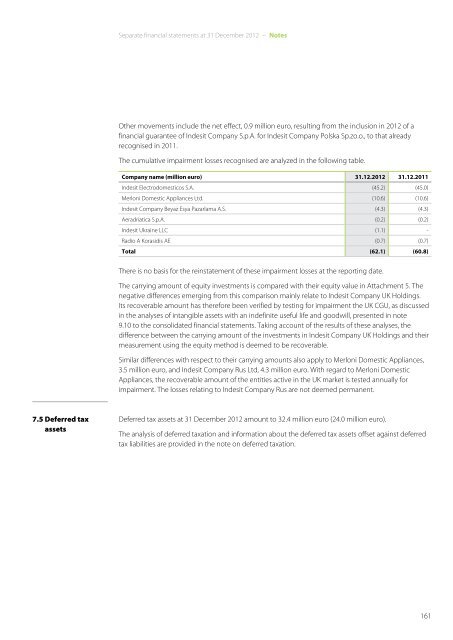

The cumulative impairment losses recognised are analyzed in the following table.<br />

Company name (million euro) 31.12.<strong>2012</strong> 31.12.2011<br />

<strong>Indesit</strong> Electrodomesticos S.A. (45.2) (45.0)<br />

Merloni Domestic Appliances Ltd. (10.6) (10.6)<br />

<strong>Indesit</strong> Company Beyaz Esya Pazarlama A.S. (4.3) (4.3)<br />

Aeradriatica S.p.A. (0.2) (0.2)<br />

<strong>Indesit</strong> Ukraine LLC (1.1) -<br />

Radio A Korasidis AE (0.7) (0.7)<br />

Total (62.1) (60.8)<br />

There is no basis for the reinstatement of these impairment losses at the reporting date.<br />

The carrying amount of equity investments is compared with their equity value in Attachment 5. The<br />

negative differences emerging from this comparison mainly relate to <strong>Indesit</strong> Company UK Holdings.<br />

Its recoverable amount has therefore been verified by testing for impairment the UK CGU, as discussed<br />

in the analyses of intangible assets with an indefinite useful life and goodwill, presented in note<br />

9.10 to the consolidated financial statements. Taking account of the results of these analyses, the<br />

difference between the carrying amount of the investments in <strong>Indesit</strong> Company UK Holdings and their<br />

measurement using the equity method is deemed to be recoverable.<br />

Similar differences with respect to their carrying amounts also apply to Merloni Domestic Appliances,<br />

3.5 million euro, and <strong>Indesit</strong> Company Rus Ltd, 4.3 million euro. With regard to Merloni Domestic<br />

Appliances, the recoverable amount of the entities active in the UK market is tested annually for<br />

impairment. The losses relating to <strong>Indesit</strong> Company Rus are not deemed permanent.<br />

7.5 Deferred tax<br />

assets<br />

Deferred tax assets at 31 December <strong>2012</strong> amount to 32.4 million euro (24.0 million euro).<br />

The analysis of deferred taxation and information about the deferred tax assets offset against deferred<br />

tax liabilities are provided in the note on deferred taxation.<br />

161