Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated financial statements at 31 December <strong>2012</strong> – Notes<br />

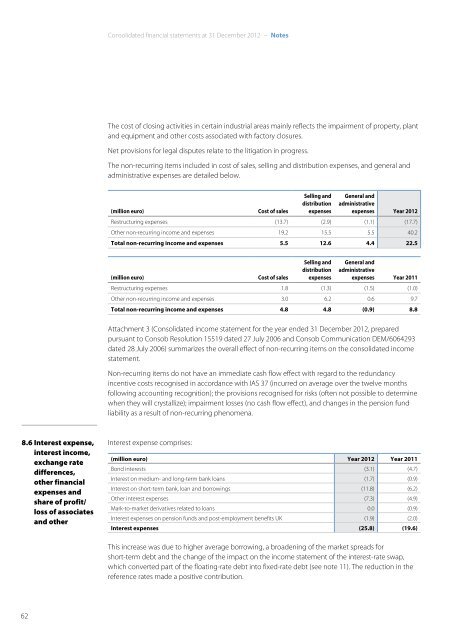

The cost of closing activities in certain industrial areas mainly reflects the impairment of property, plant<br />

and equipment and other costs associated with factory closures.<br />

Net provisions for legal disputes relate to the litigation in progress.<br />

The non-recurring items included in cost of sales, selling and distribution expenses, and general and<br />

administrative expenses are detailed below.<br />

(million euro)<br />

Cost of sales<br />

Selling and<br />

distribution<br />

expenses<br />

General and<br />

administrative<br />

expenses Year <strong>2012</strong><br />

Restructuring expenses (13.7) (2.9) (1.1) (17.7)<br />

Other non-recurring income and expenses 19.2 15.5 5.5 40.2<br />

Total non-recurring income and expenses 5.5 12.6 4.4 22.5<br />

(million euro)<br />

Cost of sales<br />

Selling and<br />

distribution<br />

expenses<br />

General and<br />

administrative<br />

expenses Year 2011<br />

Restructuring expenses 1.8 (1.3) (1.5) (1.0)<br />

Other non-recurring income and expenses 3.0 6.2 0.6 9.7<br />

Total non-recurring income and expenses 4.8 4.8 (0.9) 8.8<br />

Attachment 3 (Consolidated income statement for the year ended 31 December <strong>2012</strong>, prepared<br />

pursuant to Consob Resolution 15519 dated 27 July 2006 and Consob Communication DEM/6064293<br />

dated 28 July 2006) summarizes the overall effect of non-recurring items on the consolidated income<br />

statement.<br />

Non-recurring items do not have an immediate cash flow effect with regard to the redundancy<br />

incentive costs recognised in accordance with IAS 37 (incurred on average over the twelve months<br />

following accounting recognition); the provisions recognised for risks (often not possible to determine<br />

when they will crystallize); impairment losses (no cash flow effect), and changes in the pension fund<br />

liability as a result of non-recurring phenomena.<br />

8.6 Interest expense,<br />

interest income,<br />

exchange rate<br />

differences,<br />

other financial<br />

expenses and<br />

share of profit/<br />

loss of associates<br />

and other<br />

Interest expense comprises:<br />

(million euro) Year <strong>2012</strong> Year 2011<br />

Bond interests (3.1) (4.7)<br />

Interest on medium- and long-term bank loans (1.7) (0.9)<br />

Interest on short-term bank, loan and borrowings (11.8) (6.2)<br />

Other interest expenses (7.3) (4.9)<br />

Mark-to-market derivatives related to loans 0.0 (0.9)<br />

Interest expenses on pension funds and post-employment benefits UK (1.9) (2.0)<br />

Interest expenses (25.8) (19.6)<br />

This increase was due to higher average borrowing, a broadening of the market spreads for<br />

short-term debt and the change of the impact on the income statement of the interest-rate swap,<br />

which converted part of the floating-rate debt into fixed-rate debt (see note 11). The reduction in the<br />

reference rates made a positive contribution.<br />

62