Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated financial statements at 31 December <strong>2012</strong> – Notes<br />

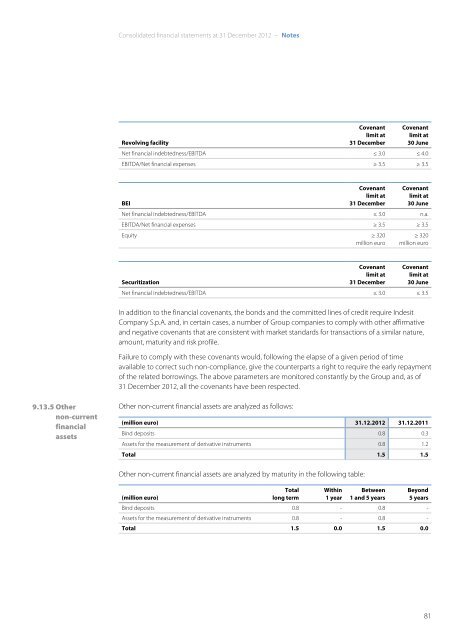

Revolving facility<br />

Covenant<br />

limit at<br />

31 December<br />

Covenant<br />

limit at<br />

30 June<br />

Net financial indebtedness/EBITDA ≤ 3.0 ≤ 4.0<br />

EBITDA/Net financial expenses ≥ 3.5 ≥ 3.5<br />

BEI<br />

Covenant<br />

limit at<br />

31 December<br />

Covenant<br />

limit at<br />

30 June<br />

Net financial indebtedness/EBITDA ≤ 3.0 n.a.<br />

EBITDA/Net financial expenses ≥ 3.5 ≥ 3.5<br />

Equity ≥ 320<br />

million euro<br />

≥ 320<br />

million euro<br />

Securitization<br />

Covenant<br />

limit at<br />

31 December<br />

Covenant<br />

limit at<br />

30 June<br />

Net financial indebtedness/EBITDA ≤ 3.0 ≤ 3.5<br />

In addition to the financial covenants, the bonds and the committed lines of credit require <strong>Indesit</strong><br />

Company S.p.A. and, in certain cases, a number of Group companies to comply with other affirmative<br />

and negative covenants that are consistent with market standards for transactions of a similar nature,<br />

amount, maturity and risk profile.<br />

Failure to comply with these covenants would, following the elapse of a given period of time<br />

available to correct such non-compliance, give the counterparts a right to require the early repayment<br />

of the related borrowings. The above parameters are monitored constantly by the Group and, as of<br />

31 December <strong>2012</strong>, all the covenants have been respected.<br />

9.13.5 Other<br />

non-current<br />

financial<br />

assets<br />

Other non-current financial assets are analyzed as follows:<br />

(million euro) 31.12.<strong>2012</strong> 31.12.2011<br />

Bind deposits 0.8 0.3<br />

Assets for the measurement of derivative instruments 0.8 1.2<br />

Total 1.5 1.5<br />

Other non-current financial assets are analyzed by maturity in the following table:<br />

(million euro)<br />

Total<br />

long term<br />

Within<br />

1 year<br />

Between<br />

1 and 5 years<br />

Beyond<br />

5 years<br />

Bind deposits 0.8 - 0.8 -<br />

Assets for the measurement of derivative instruments 0.8 - 0.8 -<br />

Total 1.5 0.0 1.5 0.0<br />

81