Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Separate financial statements at 31 December <strong>2012</strong> – Notes<br />

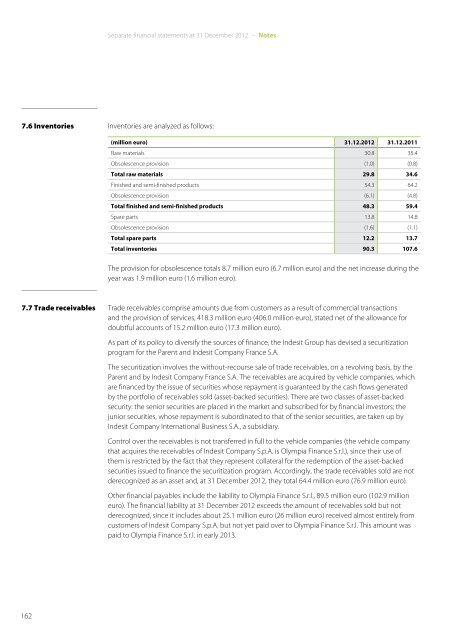

7.6 Inventories<br />

Inventories are analyzed as follows:<br />

(million euro) 31.12.<strong>2012</strong> 31.12.2011<br />

Raw materials 30.8 35.4<br />

Obsolescence provision (1.0) (0.8)<br />

Total raw materials 29.8 34.6<br />

Finished and semi-finished products 54.3 64.2<br />

Obsolescence provision (6.1) (4.8)<br />

Total finished and semi-finished products 48.3 59.4<br />

Spare parts 13.8 14.8<br />

Obsolescence provision (1.6) (1.1)<br />

Total spare parts 12.2 13.7<br />

Total inventories 90.3 107.6<br />

The provision for obsolescence totals 8.7 million euro (6.7 million euro) and the net increase during the<br />

year was 1.9 million euro (1.6 million euro).<br />

7.7 Trade receivables<br />

Trade receivables comprise amounts due from customers as a result of commercial transactions<br />

and the provision of services, 418.3 million euro (406.0 million euro), stated net of the allowance for<br />

doubtful accounts of 15.2 million euro (17.3 million euro).<br />

As part of its policy to diversify the sources of finance, the <strong>Indesit</strong> Group has devised a securitization<br />

program for the Parent and <strong>Indesit</strong> Company France S.A.<br />

The securitization involves the without-recourse sale of trade receivables, on a revolving basis, by the<br />

Parent and by <strong>Indesit</strong> Company France S.A. The receivables are acquired by vehicle companies, which<br />

are financed by the issue of securities whose repayment is guaranteed by the cash flows generated<br />

by the portfolio of receivables sold (asset-backed securities). There are two classes of asset-backed<br />

security: the senior securities are placed in the market and subscribed for by financial investors; the<br />

junior securities, whose repayment is subordinated to that of the senior securities, are taken up by<br />

<strong>Indesit</strong> Company International Business S.A., a subsidiary.<br />

Control over the receivables is not transferred in full to the vehicle companies (the vehicle company<br />

that acquires the receivables of <strong>Indesit</strong> Company S.p.A. is Olympia Finance S.r.l.), since their use of<br />

them is restricted by the fact that they represent collateral for the redemption of the asset-backed<br />

securities issued to finance the securitization program. Accordingly, the trade receivables sold are not<br />

derecognized as an asset and, at 31 December <strong>2012</strong>, they total 64.4 million euro (76.9 million euro).<br />

Other financial payables include the liability to Olympia Finance S.r.l., 89.5 million euro (102.9 million<br />

euro). The financial liability at 31 December <strong>2012</strong> exceeds the amount of receivables sold but not<br />

derecognized, since it includes about 25.1 million euro (26 million euro) received almost entirely from<br />

customers of <strong>Indesit</strong> Company S.p.A. but not yet paid over to Olympia Finance S.r.l. This amount was<br />

paid to Olympia Finance S.r.l. in early 2013.<br />

162