Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong> on operations at 31 December <strong>2012</strong><br />

Other operating costs<br />

Advertising & promotion<br />

expenses<br />

mEur<br />

30<br />

25<br />

20<br />

18.3<br />

83<br />

19.2 18.7<br />

15<br />

16.2<br />

13.7<br />

14.9<br />

11.8<br />

11.7<br />

10<br />

5<br />

0<br />

1Q 2Q 3Q 4Q<br />

3.5%<br />

3.0%<br />

2.5%<br />

2.0%<br />

1.5%<br />

1.0%<br />

0.5%<br />

0.0%<br />

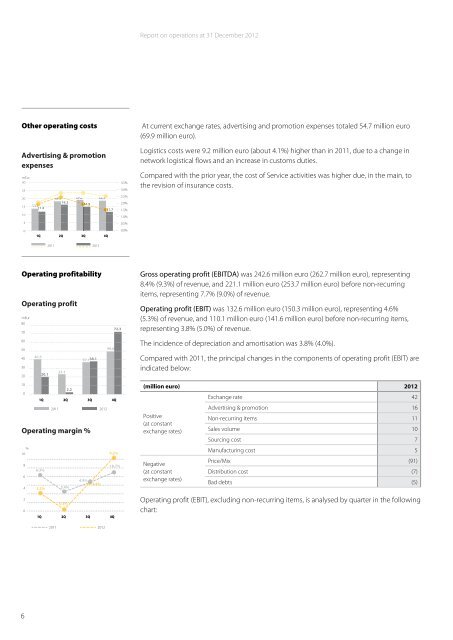

At current exchange rates, advertising and promotion expenses totaled 54.7 million euro<br />

(69.9 million euro).<br />

Logistics costs were 9.2 million euro (about 4.1%) higher than in 2011, due to a change in<br />

network logistical flows and an increase in customs duties.<br />

Compared with the prior year, the cost of Service activities was higher due, in the main, to<br />

the revision of insurance costs.<br />

2011 <strong>2012</strong><br />

Operating profitability<br />

Operating profit<br />

mEur<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

40.5<br />

37.138.1<br />

20<br />

20.1<br />

23.1<br />

49.6<br />

72.3<br />

Gross operating profit (EBITDA) was 242.6 million euro (262.7 million euro), representing<br />

8.4% (9.3%) of revenue, and 221.1 million euro (253.7 million euro) before non-recurring<br />

items, representing 7.7% (9.0%) of revenue.<br />

Operating profit (EBIT) was 132.6 million euro (150.3 million euro), representing 4.6%<br />

(5.3%) of revenue, and 110.1 million euro (141.6 million euro) before non-recurring items,<br />

representing 3.8% (5.0%) of revenue.<br />

The incidence of depreciation and amortisation was 3.8% (4.0%).<br />

Compared with 2011, the principal changes in the components of operating profit (EBIT) are<br />

indicated below:<br />

10<br />

2.2<br />

0<br />

1Q 2Q 3Q 4Q<br />

2011 <strong>2012</strong><br />

Operating margin %<br />

%<br />

10<br />

8<br />

9.2%<br />

18.7%<br />

6.3%<br />

6<br />

4.9%<br />

4.8%<br />

4<br />

2<br />

3.2% 3.4%<br />

0.3%<br />

0<br />

1Q 2Q 3Q 4Q<br />

(million euro) <strong>2012</strong><br />

Exchange rate 42<br />

Advertising & promotion 16<br />

Positive<br />

Non-recurring items 11<br />

(at constant<br />

exchange rates) Sales volume 10<br />

Sourcing cost 7<br />

Manufacturing cost 5<br />

Negative<br />

Price/Mix (91)<br />

(at constant<br />

Distribution cost (7)<br />

exchange rates)<br />

Bad debts (5)<br />

Operating profit (EBIT), excluding non-recurring items, is analysed by quarter in the following<br />

chart:<br />

2011 <strong>2012</strong><br />

6