Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Separate financial statements at 31 December <strong>2012</strong> – Notes<br />

9. Financial instruments<br />

9.1 Management<br />

of financial risks<br />

<strong>Indesit</strong> Company S.p.A. manages its principal financial risks in accordance with the guidelines set out in<br />

the Treasury Policy approved by the Board of Directors.<br />

A detailed analysis of the policies and practices adopted for the management of financial risks is<br />

presented in the notes to the consolidated financial statements, together with the other information<br />

required by IFRS 7.<br />

The following information is presented with regard to <strong>Indesit</strong> Company S.p.A.: information on the<br />

transactions outstanding as of 31 December <strong>2012</strong>, the carrying amount of the financial assets and<br />

liabilities recognised in the statement of financial position, for each of the categories identified in IAS<br />

39, the analysis of financial payables by maturity, and certain quantitative (sensitivity) information about<br />

interest-rate risk.<br />

With regard to exchange-rate risk, there are no significant exposures in currencies other than the euro.<br />

Interest-rate risk:<br />

sensitivity<br />

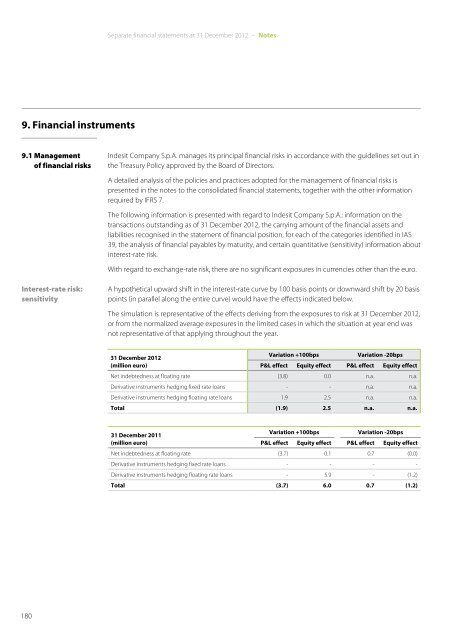

A hypothetical upward shift in the interest-rate curve by 100 basis points or downward shift by 20 basis<br />

points (in parallel along the entire curve) would have the effects indicated below.<br />

The simulation is representative of the effects deriving from the exposures to risk at 31 December <strong>2012</strong>,<br />

or from the normalized average exposures in the limited cases in which the situation at year end was<br />

not representative of that applying throughout the year.<br />

31 December <strong>2012</strong><br />

Variation +100bps<br />

Variation -20bps<br />

(million euro)<br />

P&L effect Equity effect P&L effect Equity effect<br />

Net indebtedness at floating rate (3.8) 0.0 n.a. n.a.<br />

Derivative instruments hedging fixed rate loans - - n.a. n.a.<br />

Derivative instruments hedging floating rate loans 1.9 2.5 n.a. n.a.<br />

Total (1.9) 2.5 n.a. n.a.<br />

31 December 2011<br />

Variation +100bps<br />

Variation -20bps<br />

(million euro)<br />

P&L effect Equity effect P&L effect Equity effect<br />

Net indebtedness at floating rate (3.7) 0.1 0.7 (0.0)<br />

Derivative instruments hedging fixed rate loans - - - -<br />

Derivative instruments hedging floating rate loans - 5.9 - (1.2)<br />

Total (3.7) 6.0 0.7 (1.2)<br />

180