Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated financial statements at 31 December <strong>2012</strong> – Notes<br />

The net financial liabilities to third parties of the consolidated vehicle companies amount to<br />

62.0 million euro at 31 December <strong>2012</strong>, comprising senior securities issued on the ABS market,<br />

87.1 million euro, net of the cash held by them, 25.0 million euro.<br />

At the same date, the liability of Group operating companies to vehicle companies for receivables sold<br />

but not yet collected amounts to 115.7 million euro, while their financial receivables represented by<br />

junior securities total 51.0 million euro.<br />

The without-recourse sale of UK and Polish receivables reduced trade receivables by 30.8 million euro,<br />

being the amount sold but not collected by 31 December <strong>2012</strong> (23.4 million euro in UK).<br />

The concentration risk associated with the 10 largest customers is 19.9% (21.3% in 2011) of total gross<br />

performing receivables.<br />

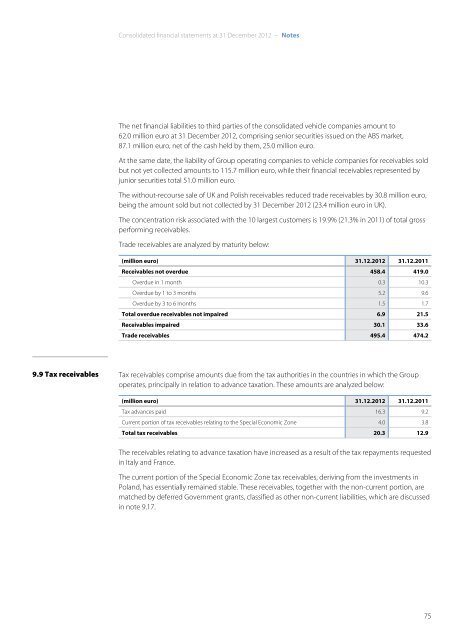

Trade receivables are analyzed by maturity below:<br />

(million euro) 31.12.<strong>2012</strong> 31.12.2011<br />

Receivables not overdue 458.4 419.0<br />

Overdue in 1 month 0.3 10.3<br />

Overdue by 1 to 3 months 5.2 9.6<br />

Overdue by 3 to 6 months 1.5 1.7<br />

Total overdue receivables not impaired 6.9 21.5<br />

Receivables impaired 30.1 33.6<br />

Trade receivables 495.4 474.2<br />

9.9 Tax receivables<br />

Tax receivables comprise amounts due from the tax authorities in the countries in which the Group<br />

operates, principally in relation to advance taxation. These amounts are analyzed below:<br />

(million euro) 31.12.<strong>2012</strong> 31.12.2011<br />

Tax advances paid 16.3 9.2<br />

Current portion of tax receivables relating to the Special Economic Zone 4.0 3.8<br />

Total tax receivables 20.3 12.9<br />

The receivables relating to advance taxation have increased as a result of the tax repayments requested<br />

in Italy and France.<br />

The current portion of the Special Economic Zone tax receivables, deriving from the investments in<br />

Poland, has essentially remained stable. These receivables, together with the non-current portion, are<br />

matched by deferred Government grants, classified as other non-current liabilities, which are discussed<br />

in note 9.17.<br />

75