Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

Annual Report 2012 - Indesit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated financial statements at 31 December <strong>2012</strong> – Notes<br />

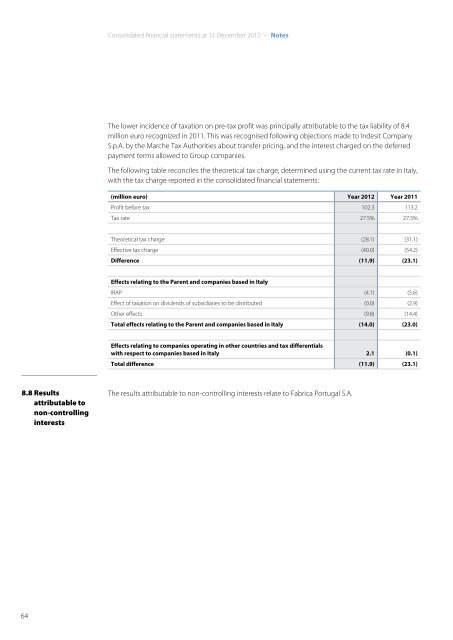

The lower incidence of taxation on pre-tax profit was principally attributable to the tax liability of 8.4<br />

million euro recognized in 2011. This was recognised following objections made to <strong>Indesit</strong> Company<br />

S.p.A. by the Marche Tax Authorities about transfer pricing, and the interest charged on the deferred<br />

payment terms allowed to Group companies.<br />

The following table reconciles the theoretical tax charge, determined using the current tax rate in Italy,<br />

with the tax charge reported in the consolidated financial statements:<br />

(million euro) Year <strong>2012</strong> Year 2011<br />

Profit before tax 102.3 113.2<br />

Tax rate 27.5% 27.5%<br />

Theoretical tax charge (28.1) (31.1)<br />

Effective tax charge (40.0) (54.2)<br />

Difference (11.9) (23.1)<br />

Effects relating to the Parent and companies based in Italy<br />

IRAP (4.1) (5.6)<br />

Effect of taxation on dividends of subsidiaries to be distributed (0.0) (2.9)<br />

Other effects (9.8) (14.4)<br />

Total effects relating to the Parent and companies based in Italy (14.0) (23.0)<br />

Effects relating to companies operating in other countries and tax differentials<br />

with respect to companies based in Italy 2.1 (0.1)<br />

Total difference (11.9) (23.1)<br />

8.8 Results<br />

attributable to<br />

non-controlling<br />

interests<br />

The results attributable to non-controlling interests relate to Fabrica Portugal S.A.<br />

64