You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

protect against cyclical market declines. Diversification is<br />

tied to management by <strong>the</strong> fact that it must be informed<br />

and intelligent, not merely wide; it must be managed<br />

ra<strong>the</strong>r than random. Most funds do use sound judgment<br />

in diversifying <strong>the</strong>ir portfolios, and <strong>the</strong> criticism that <strong>the</strong><br />

funds merely “buy <strong>the</strong> averages” is seen as invalid, since<br />

a survey by <strong>the</strong> writer of twenty funds indicated that each<br />

had an average of but eight of <strong>the</strong> thirty widely-known<br />

stocks <strong>com</strong>prising <strong>the</strong> Dow-Jones Industrial Average. The<br />

fallacy of merely wide diversification is clearly indicated<br />

by <strong>the</strong> stock market crash of 1929. Although closed-end<br />

leverage <strong>com</strong>panies averaged 87 <strong>issue</strong>s in <strong>the</strong>ir portfolios,<br />

and closed-end non-leverage <strong>com</strong>panies averaged 60.2<br />

<strong>issue</strong>s, <strong>the</strong>ir capital decline was far more severe than that<br />

of <strong>the</strong> open-end <strong>com</strong>panies, which averaged only 46.8<br />

<strong>issue</strong>s. 10 The latter were virtually required to buy sound,<br />

seasoned, marketable <strong>issue</strong>s, primarily because <strong>the</strong>y had<br />

to be able to liquidate parts of <strong>the</strong>ir portfolios on demand<br />

for redemptions by shareholders.<br />

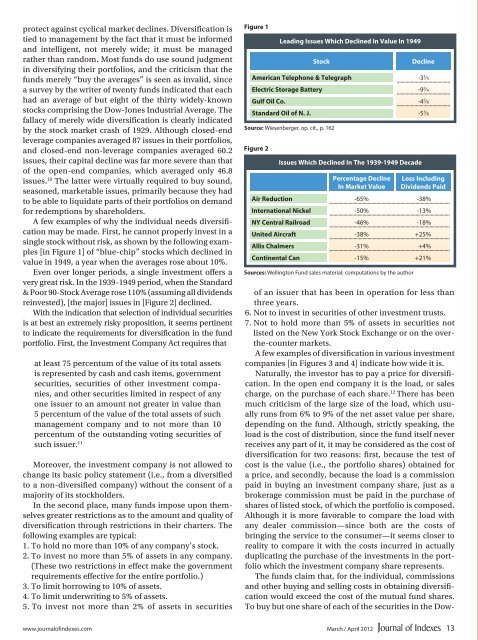

A few examples of why <strong>the</strong> individual needs diversification<br />

may be made. First, he cannot properly invest in a<br />

single stock without risk, as shown by <strong>the</strong> following examples<br />

[in Figure 1] of “blue-chip” stocks which declined in<br />

value in 1949, a year when <strong>the</strong> averages rose about 10%.<br />

Even over longer periods, a single investment offers a<br />

very great risk. In <strong>the</strong> 1939–1949 period, when <strong>the</strong> Standard<br />

& Poor 90-Stock Average rose 110% (assuming all dividends<br />

reinvested), [<strong>the</strong> major] <strong>issue</strong>s in [Figure 2] declined.<br />

With <strong>the</strong> indication that selection of individual securities<br />

is at best an extremely risky proposition, it seems pertinent<br />

to indicate <strong>the</strong> requirements for diversification in <strong>the</strong> fund<br />

portfolio. First, <strong>the</strong> Investment Company Act requires that<br />

at least 75 percentum of <strong>the</strong> value of its total assets<br />

is represented by cash and cash items, government<br />

securities, securities of o<strong>the</strong>r investment <strong>com</strong>panies,<br />

and o<strong>the</strong>r securities limited in respect of any<br />

one <strong>issue</strong>r to an amount not greater in value than<br />

5 percentum of <strong>the</strong> value of <strong>the</strong> total assets of such<br />

management <strong>com</strong>pany and to not more than 10<br />

percentum of <strong>the</strong> outstanding voting securities of<br />

such <strong>issue</strong>r. 11<br />

Moreover, <strong>the</strong> investment <strong>com</strong>pany is not allowed to<br />

change its basic policy statement (i.e., from a diversified<br />

to a non-diversified <strong>com</strong>pany) without <strong>the</strong> consent of a<br />

majority of its stockholders.<br />

In <strong>the</strong> second place, many funds impose upon <strong>the</strong>mselves<br />

greater restrictions as to <strong>the</strong> amount and quality of<br />

diversification through restrictions in <strong>the</strong>ir charters. The<br />

following examples are typical:<br />

1. To hold no more than 10% of any <strong>com</strong>pany’s stock.<br />

2. To invest no more than 5% of assets in any <strong>com</strong>pany.<br />

(These two restrictions in effect make <strong>the</strong> government<br />

requirements effective for <strong>the</strong> entire portfolio.)<br />

3. To limit borrowing to 10% of assets.<br />

4. To limit underwriting to 5% of assets.<br />

5. To invest not more than 2% of assets in securities<br />

Figure 1<br />

Figure 2<br />

Leading Issues Which Declined In Value In 1949<br />

Stock<br />

Source: Wiesenberger, op. cit., p. 162<br />

Issues Which Declined In The 1939-1949 Decade<br />

Percentage Decline<br />

In Market Value<br />

Air Reduction -65% -38%<br />

International Nickel -50% -13%<br />

NY Central Railroad -46% -18%<br />

United Aircraft -38% +25%<br />

Allis Chalmers -31% +4%<br />

Continental Can -15% +21%<br />

Sources: Wellington Fund sales material; <strong>com</strong>putations by <strong>the</strong> author<br />

Decline<br />

American Telephone & Telegraph -3 3 ⁄4<br />

Electric Storage Battery -9 3 ⁄4<br />

Gulf Oil Co. -4 5 ⁄8<br />

Standard Oil of N. J. -5 3 ⁄8<br />

Loss Including<br />

Dividends Paid<br />

of an <strong>issue</strong>r that has been in operation for less than<br />

three years.<br />

6. Not to invest in securities of o<strong>the</strong>r investment trusts.<br />

7. Not to hold more than 5% of assets in securities not<br />

listed on <strong>the</strong> New York Stock Exchange or on <strong>the</strong> over<strong>the</strong>-counter<br />

markets.<br />

A few examples of diversification in various investment<br />

<strong>com</strong>panies [in Figures 3 and 4] indicate how wide it is.<br />

Naturally, <strong>the</strong> investor has to pay a price for diversification.<br />

In <strong>the</strong> open end <strong>com</strong>pany it is <strong>the</strong> load, or sales<br />

charge, on <strong>the</strong> purchase of each share. 12 There has been<br />

much criticism of <strong>the</strong> large size of <strong>the</strong> load, which usually<br />

runs from 6% to 9% of <strong>the</strong> net asset value per share,<br />

depending on <strong>the</strong> fund. Although, strictly speaking, <strong>the</strong><br />

load is <strong>the</strong> cost of distribution, since <strong>the</strong> fund itself never<br />

receives any part of it, it may be considered as <strong>the</strong> cost of<br />

diversification for two reasons: first, because <strong>the</strong> test of<br />

cost is <strong>the</strong> value (i.e., <strong>the</strong> portfolio shares) obtained for<br />

a price, and secondly, because <strong>the</strong> load is a <strong>com</strong>mission<br />

paid in buying an investment <strong>com</strong>pany share, just as a<br />

brokerage <strong>com</strong>mission must be paid in <strong>the</strong> purchase of<br />

shares of listed stock, of which <strong>the</strong> portfolio is <strong>com</strong>posed.<br />

Although it is more favorable to <strong>com</strong>pare <strong>the</strong> load with<br />

any dealer <strong>com</strong>mission—since both are <strong>the</strong> costs of<br />

bringing <strong>the</strong> service to <strong>the</strong> consumer—it seems closer to<br />

reality to <strong>com</strong>pare it with <strong>the</strong> costs incurred in actually<br />

duplicating <strong>the</strong> purchase of <strong>the</strong> investments in <strong>the</strong> portfolio<br />

which <strong>the</strong> investment <strong>com</strong>pany share represents.<br />

The funds claim that, for <strong>the</strong> individual, <strong>com</strong>missions<br />

and o<strong>the</strong>r buying and selling costs in obtaining diversification<br />

would exceed <strong>the</strong> cost of <strong>the</strong> mutual fund shares.<br />

To buy but one share of each of <strong>the</strong> securities in <strong>the</strong> Dowwww.journalofindexes.<strong>com</strong><br />

March / April 2012 13