Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

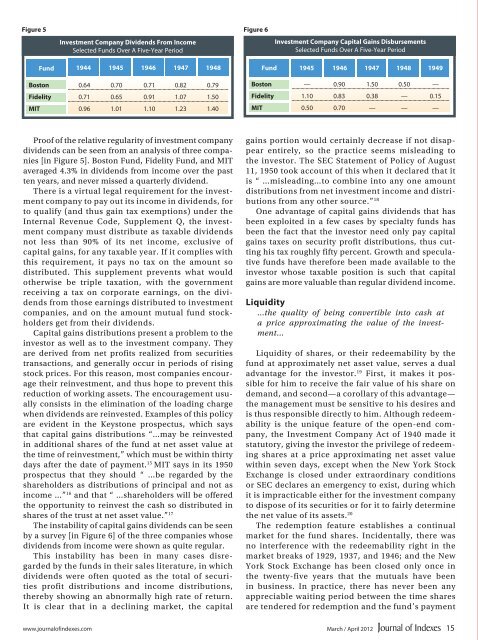

Figure 5<br />

Figure 6<br />

Investment Company Dividends From In<strong>com</strong>e<br />

Selected Funds Over A Five-Year Period<br />

Investment Company Capital Gains Disbursements<br />

Selected Funds Over A Five-Year Period<br />

Fund<br />

1944 1945 1946 1947<br />

1948<br />

Fund<br />

1945 1946 1947 1948 1949<br />

Boston 0.64 0.70 0.71 0.82 0.79<br />

Fidelity 0.71 0.65 0.91 1.07 1.50<br />

MIT 0.96 1.01 1.10 1.23 1.40<br />

Boston — 0.90 1.50 0.50 —<br />

Fidelity 1.10 0.83 0.38 — 0.15<br />

MIT 0.50 0.70 — — —<br />

Proof of <strong>the</strong> relative regularity of investment <strong>com</strong>pany<br />

dividends can be seen from an analysis of three <strong>com</strong>panies<br />

[in Figure 5]. Boston Fund, Fidelity Fund, and MIT<br />

averaged 4.3% in dividends from in<strong>com</strong>e over <strong>the</strong> past<br />

ten years, and never missed a quarterly dividend.<br />

There is a virtual legal requirement for <strong>the</strong> investment<br />

<strong>com</strong>pany to pay out its in<strong>com</strong>e in dividends, for<br />

to qualify (and thus gain tax exemptions) under <strong>the</strong><br />

Internal Revenue Code, Supplement Q, <strong>the</strong> investment<br />

<strong>com</strong>pany must distribute as taxable dividends<br />

not less than 90% of its net in<strong>com</strong>e, exclusive of<br />

capital gains, for any taxable year. If it <strong>com</strong>plies with<br />

this requirement, it pays no tax on <strong>the</strong> amount so<br />

distributed. This supplement prevents what would<br />

o<strong>the</strong>rwise be triple taxation, with <strong>the</strong> government<br />

receiving a tax on corporate earnings, on <strong>the</strong> dividends<br />

from those earnings distributed to investment<br />

<strong>com</strong>panies, and on <strong>the</strong> amount mutual fund stockholders<br />

get from <strong>the</strong>ir dividends.<br />

Capital gains distributions present a problem to <strong>the</strong><br />

investor as well as to <strong>the</strong> investment <strong>com</strong>pany. They<br />

are derived from net profits realized from securities<br />

transactions, and generally occur in periods of rising<br />

stock prices. For this reason, most <strong>com</strong>panies encourage<br />

<strong>the</strong>ir reinvestment, and thus hope to prevent this<br />

reduction of working assets. The encouragement usually<br />

consists in <strong>the</strong> elimination of <strong>the</strong> loading charge<br />

when dividends are reinvested. Examples of this policy<br />

are evident in <strong>the</strong> Keystone prospectus, which says<br />

that capital gains distributions “…may be reinvested<br />

in additional shares of <strong>the</strong> fund at net asset value at<br />

<strong>the</strong> time of reinvestment,” which must be within thirty<br />

days after <strong>the</strong> date of payment. 15 MIT says in its 1950<br />

prospectus that <strong>the</strong>y should “ …be regarded by <strong>the</strong><br />

shareholders as distributions of principal and not as<br />

in<strong>com</strong>e …” 16 and that “ …shareholders will be offered<br />

<strong>the</strong> opportunity to reinvest <strong>the</strong> cash so distributed in<br />

shares of <strong>the</strong> trust at net asset value.” 17<br />

The instability of capital gains dividends can be seen<br />

by a survey [in Figure 6] of <strong>the</strong> three <strong>com</strong>panies whose<br />

dividends from in<strong>com</strong>e were shown as quite regular.<br />

This instability has been in many cases disregarded<br />

by <strong>the</strong> funds in <strong>the</strong>ir sales literature, in which<br />

dividends were often quoted as <strong>the</strong> total of securities<br />

profit distributions and in<strong>com</strong>e distributions,<br />

<strong>the</strong>reby showing an abnormally high rate of return.<br />

It is clear that in a declining market, <strong>the</strong> capital<br />

gains portion would certainly decrease if not disappear<br />

entirely, so <strong>the</strong> practice seems misleading to<br />

<strong>the</strong> investor. The SEC Statement of Policy of August<br />

11, 1950 took account of this when it declared that it<br />

is “ …misleading…to <strong>com</strong>bine into any one amount<br />

distributions from net investment in<strong>com</strong>e and distributions<br />

from any o<strong>the</strong>r source.” 18<br />

One advantage of capital gains dividends that has<br />

been exploited in a few cases by specialty funds has<br />

been <strong>the</strong> fact that <strong>the</strong> investor need only pay capital<br />

gains taxes on security profit distributions, thus cutting<br />

his tax roughly fifty percent. Growth and speculative<br />

funds have <strong>the</strong>refore been made available to <strong>the</strong><br />

investor whose taxable position is such that capital<br />

gains are more valuable than regular dividend in<strong>com</strong>e.<br />

Liquidity<br />

…<strong>the</strong> quality of being convertible into cash at<br />

a price approximating <strong>the</strong> value of <strong>the</strong> investment…<br />

Liquidity of shares, or <strong>the</strong>ir redeemability by <strong>the</strong><br />

fund at approximately net asset value, serves a dual<br />

advantage for <strong>the</strong> investor. 19 First, it makes it possible<br />

for him to receive <strong>the</strong> fair value of his share on<br />

demand, and second—a corollary of this advantage—<br />

<strong>the</strong> management must be sensitive to his desires and<br />

is thus responsible directly to him. Although redeemability<br />

is <strong>the</strong> unique feature of <strong>the</strong> open-end <strong>com</strong>pany,<br />

<strong>the</strong> Investment Company Act of 1940 made it<br />

statutory, giving <strong>the</strong> investor <strong>the</strong> privilege of redeeming<br />

shares at a price approximating net asset value<br />

within seven days, except when <strong>the</strong> New York Stock<br />

Exchange is closed under extraordinary conditions<br />

or SEC declares an emergency to exist, during which<br />

it is impracticable ei<strong>the</strong>r for <strong>the</strong> investment <strong>com</strong>pany<br />

to dispose of its securities or for it to fairly determine<br />

<strong>the</strong> net value of its assets. 20<br />

The redemption feature establishes a continual<br />

market for <strong>the</strong> fund shares. Incidentally, <strong>the</strong>re was<br />

no interference with <strong>the</strong> redeemability right in <strong>the</strong><br />

market breaks of 1929, 1937, and 1946; and <strong>the</strong> New<br />

York Stock Exchange has been closed only once in<br />

<strong>the</strong> twenty-five years that <strong>the</strong> mutuals have been<br />

in business. In practice, <strong>the</strong>re has never been any<br />

appreciable waiting period between <strong>the</strong> time shares<br />

are tendered for redemption and <strong>the</strong> fund’s payment<br />

www.journalofindexes.<strong>com</strong> March / April 2012 15