Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Figure 6a<br />

Figure 7a<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

Mid- And Small-Cap Funds Vs. Russell Benchmarks<br />

5.32%<br />

Active MidCap<br />

Funds<br />

5.30%<br />

4.26%<br />

Russell MidCap Active SmallCap Russell 2000<br />

Funds<br />

Sources: U.S. SPIVA Scorecards dated August 24, 2011; Bloomberg<br />

Figure 6b<br />

Mid- And Small-Cap Funds Vs. S&P Benchmarks<br />

4.08%<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Fund Death Rate Over 3 Years<br />

Sources: U.S. SPIVA Scorecards dated August 24, 2011; Bloomberg<br />

Figure 7b<br />

16%<br />

18%<br />

17%<br />

10%<br />

Large Cap Mid Cap Small Cap General<br />

Muni. Debt<br />

17% 17%<br />

California<br />

Muni. Debt<br />

New York<br />

Muni. Debt<br />

% Of Large-Cap Funds Beating Benchmarks Over 5 Years<br />

7%<br />

6%<br />

5%<br />

4%<br />

5.32%<br />

6.59%<br />

4.26%<br />

4.61%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

51.9%<br />

64.7%<br />

81.3%<br />

3%<br />

2%<br />

1%<br />

40%<br />

30%<br />

20%<br />

10%<br />

19.6%<br />

30.0%<br />

37.5%<br />

0%<br />

Active Mid-Cap<br />

Funds<br />

S&P MidCap 400 Active Small-Cap S&P SmallCap 600<br />

Funds<br />

0%<br />

LC Growth Funds LC Blend Funds<br />

■ All Funds ■ Surviving Funds<br />

LC Value Funds<br />

Sources: U.S. SPIVA Scorecards dated August 24, 2011; Bloomberg<br />

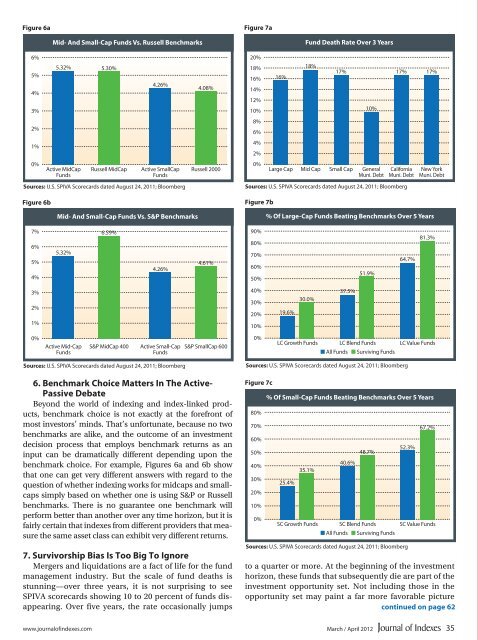

6. Benchmark Choice Matters In The Active-<br />

Passive Debate<br />

Beyond <strong>the</strong> world of indexing and index-linked products,<br />

benchmark choice is not exactly at <strong>the</strong> forefront of<br />

most investors’ minds. That’s unfortunate, because no two<br />

benchmarks are alike, and <strong>the</strong> out<strong>com</strong>e of an investment<br />

decision process that employs benchmark returns as an<br />

input can be dramatically different depending upon <strong>the</strong><br />

benchmark choice. For example, Figures 6a and 6b show<br />

that one can get very different answers with regard to <strong>the</strong><br />

question of whe<strong>the</strong>r indexing works for midcaps and smallcaps<br />

simply based on whe<strong>the</strong>r one is using S&P or Russell<br />

benchmarks. There is no guarantee one benchmark will<br />

perform better than ano<strong>the</strong>r over any time horizon, but it is<br />

fairly certain that indexes from different providers that measure<br />

<strong>the</strong> same asset class can exhibit very different returns.<br />

7. Survivorship Bias Is Too Big To Ignore<br />

Mergers and liquidations are a fact of life for <strong>the</strong> fund<br />

management industry. But <strong>the</strong> scale of fund deaths is<br />

stunning—over three years, it is not surprising to see<br />

SPIVA scorecards showing 10 to 20 percent of funds disappearing.<br />

Over five years, <strong>the</strong> rate occasionally jumps<br />

Sources: U.S. SPIVA Scorecards dated August 24, 2011; Bloomberg<br />

Figure 7c<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

% Of Small-Cap Funds Beating Benchmarks Over 5 Years<br />

25.4%<br />

35.1%<br />

SC Growth Funds<br />

40.6%<br />

48.7%<br />

SC Blend Funds<br />

■ All Funds ■ Surviving Funds<br />

Sources: U.S. SPIVA Scorecards dated August 24, 2011; Bloomberg<br />

52.3%<br />

67.2%<br />

SC Value Funds<br />

to a quarter or more. At <strong>the</strong> beginning of <strong>the</strong> investment<br />

horizon, <strong>the</strong>se funds that subsequently die are part of <strong>the</strong><br />

investment opportunity set. Not including those in <strong>the</strong><br />

opportunity set may paint a far more favorable picture<br />

continued on page 62<br />

www.journalofindexes.<strong>com</strong> March / April 2012 35